The Growth Imperative: Industries, Innovation and Wealth in a Changing Economy

• 7 min read

Get the Latest Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

The current administration has a number of economic goals with the potential to significantly impact annual U.S. growth. Are those goals achievable and what might the economic environment look like over the next 10 to 15 years?

To examine where we are headed into 2026 and potential paths ahead, AMG National Trust presented “The Growth Imperative: Industries, Innovation and Wealth in a Changing Economy.” The Dec. 16 event featured Dr. Jonathn Moyer, an Associate Professor at the University of Denver’s Korbel School and Director of the Frederick S. Pardee Institute for International Futures. Providing perspective from AMG were Earl Wright, Chairman and co-founder; Dr. Michael Bergmann, Chief Investment Officer and co-founder; Josh Stevens, Senior Vice President, AMG Capital Management; and Chris Jacoby, Senior Vice President, Private Capital.

Where We Stand Today

“2025 was a pretty decent year,” Dr. Bergmann said in starting the conversation. The year has been shaped by three forces: the boom in artificial intelligence (AI), passage of the One Big Beautiful Bill Act (OBBBA) and the legislation tied to ending the recent government shutdown, and tariffs.

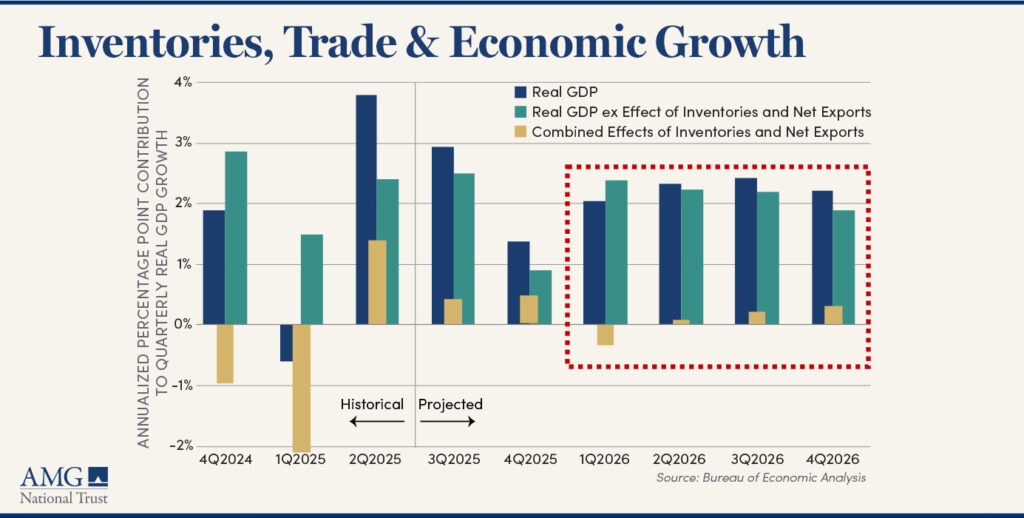

The previous year, gross domestic product (GDP) grew by about 3%, supported by robust consumer spending before slowing slightly in the fourth quarter. Up to that point, businesses had grown accustomed to high levels of growth and had built up inventories before reversing course and delivering goods out of inventories rather than production. “GDP wasn’t as big because actual production wasn’t as high,” Dr. Bergmann said.

The picture changed again in the first quarter of this year; Dr. Bergmann explained that “we had a change of administrations … (and) they started talking about tariffs.”

“And so, people bought cars and washing machines and so forth that were made abroad, and businesses bought all kinds of equipment that came from abroad. They shifted purchases from what would’ve been domestic production to foreign production.”

The effect reversed in the second quarter: imports slowed, inventories rose, domestic production rebounded, and investment in AI-related equipment and software provided an additional boost.

Looking ahead, Dr. Bergmann expects steady growth near 2% as the economy overcomes tariffs now in place and benefits from the OBBBA, which extends tax cuts and adds incentives that should more than offset the impact of reducing some subsidies for green investments and social programs.

Foundational Change in the Works

Based on the Trump administration’s goals, the path ahead could bring about a massive, foundational economic shift as the administration undertakes to reestablish America’s manufacturing base, Mr. Wright said as he picked up the conversation. Core heavy industries (e.g., steel, aluminum, semiconductors, and AI-related hardware) are to be strengthened, along with plant and equipment expansion.

Mr. Wright outlined some of the financial and policy changes intended to bring about this new industrial base:

- Broad tariffs

- Extension of the tax cuts in the Tax Cuts and Jobs Act

- Targeted protections for key products, and new incentives for domestic production

- Investments to create next-generation manufacturing

- Corporate incentives, via the OBBA, to encourage more capital expenditures (capex). (Capex being suggested for AI over the next five to seven years is $7 trillion, Mr. Wright said.)

- Energy independence, including gas and fossil fuels, and nuclear power

- Less regulation

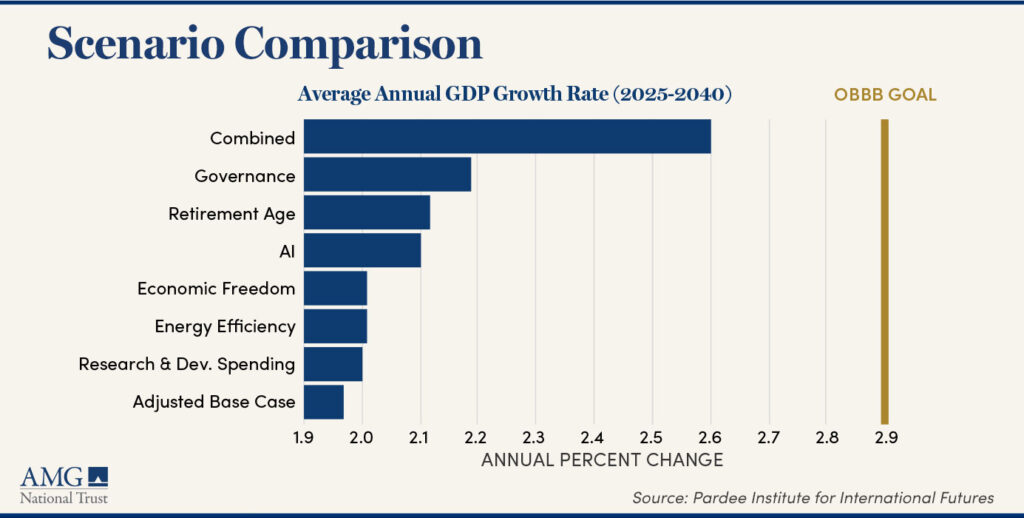

The administration believes its policies could drive real GDP growth as high as 2.9% through 2040, Mr. Wright added. The Congressional Budget Office, in contrast, projects more modest economic growth of around 1.8% and warns that these plans could increase the deficit by $3 trillion.

To better assess these competing views, AMG turned to Dr. Moyer, whose long-term economic modeling is widely used by governments and international institutions, to evaluate how the administration’s goals might realistically translate into future growth.

Building Blocks and Scenarios

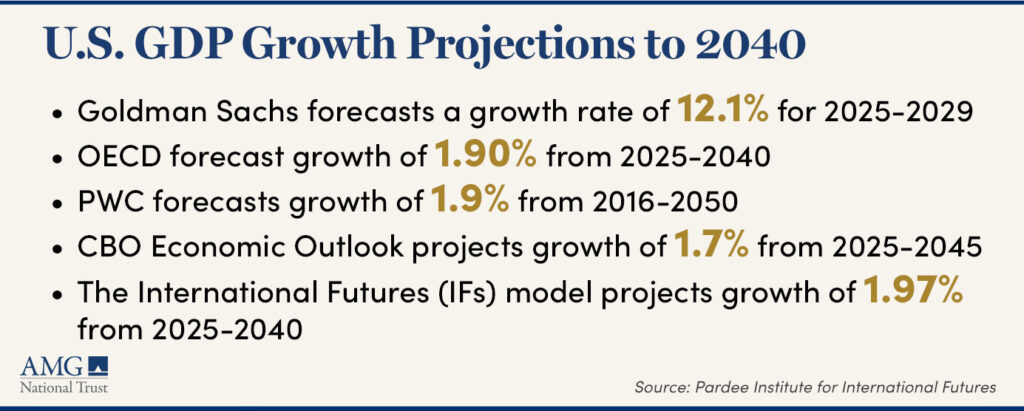

With the 2.9% target in mind, Dr. Moyer looked at others’ projections of U.S. growth to 2040 along with the Pardee Institute’s International Futures (IFs) model (which forecasts hundreds of indicators across human, social, and natural systems for 188 countries and captures how shifts in one area impact others). All projected somewhat more modest outcomes.

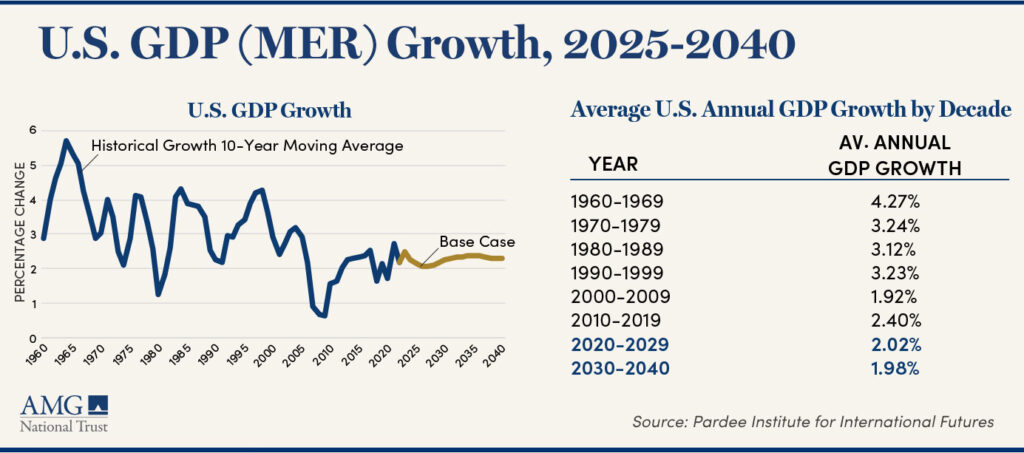

Dr. Moyer then pointed to average U.S. annual GDP growth by decade since 1960.

“One insight from economic modeling, long-term macro modeling, that’s generally accepted is that richer countries tend to grow more slowly across time (than would a less developed nation). And that’s true for what you see in the U.S. average (growth by decade), 4% to 3.2, 3.1 to 3.2, 1.9, we bump up to 2.4.”

However, there are measures the United States could use to potentially “goose the growth,” Dr. Moyer said.

“Increasing R&D doesn’t do much because we already do a ton of it,” Dr. Moyer said. Likewise, the U.S. already does well in terms of energy efficiency and economic freedom.

“The AI boom definitely gooses average growth. … Though I’ll stress the uncertainty here is massive.”

Raising the retirement age to 71 over six years and improving governance in a way that leads to more efficiency and predictability would have a potentially greater impact. Combining all of the above, the model shows, could potentially unlock a “remarkable” average annual 2.6% growth over the next 15 years—”close to $25 trillion in real GDP value through 2040.”

What would the transformations drive? For one, it would dampen the economic rise of China, Dr. Moyer said. Standard of living, well-being, and trade production would also be impacted.

“Am I showing you how to do this? No, that’s, that’s not our job. We’re also focusing on the upside. We’re not focusing nearly as much on the downside”—geopolitical shocks such as if China were to invade Taiwan, environmental disruptions, or dystopian scenarios (what if AI were to go wild).

Potential Growth Drivers and Positioning a Portfolio

In light of these scenarios, what could influence potential opportunities for investment, Mr. Wright asked.

Role of AI

Maintaining innovation is critical to achieving the administration’s higher growth potential, Mr. Jacoby said, and integral to that is AI, which is “impacting everything”—not just the capex and infrastructure boom but also accounting, legal, engineering, biotechnology, pharmaceutical.

As an example, he said, chemical companies are using biological processes to displace traditional chemical manufacturing, resulting in greater efficiency and higher margins. One benefit already is that the manufacturing of critical inputs is beginning to return to the U.S. for the first time in decades.

Some of the companies’ work is still early stage but very promising, he added.

Mitigating Risk in Portfolio

This discussion is a tale of two environments between now and 2040 characterized by markedly disparate levels of potential economic growth and corresponding market opportunities and risks. To highlight the opportunities and how to manage risk in either environment, Mr. Stevens created two scenarios: one with high annual GDP growth (2.7%) and one with lower growth of 2.0%.

A portfolio for the former would tend to be more U.S.-centric: “(In a 2.7% GDP growth environment) we’re going to drive such a large gap between us and the rest of the world … most of the profit would be generated here.”

Under a 2.0% scenario, “It’s a little bit about capturing opportunities,” Mr. Stevens said. “… Still trying to grow wealth, still trying to preserve wealth, but recognizing that we’d want to have much more of a diversified and global footprint.”

He also emphasized that for venture capital, “innovation never sleeps” and “the opportunities are going to be there” whether GDP growth is 2.0%, 2.7%, or elsewhere.

AMG Helps Investors Prepare

AMG strives to help clients understand how policy actions today could impact long-term growth and investment opportunities. We can assist with comprehensive planning around each client’s unique business and personal circumstances, helping clients to make prompt and informed decisions to benefit their financial well-being.

Find out more about AMG’s Personal Financial Management (PFM) or to book a free consultation call 303-486-1475 or email us the best day and time to reach you.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.