2024-2026 Economic Outlook: Expect A Slow Start

• 10 min read

- Brief: Global Economy

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.

2023 included a number of surprises between what was forecast and the eventual outcomes. For instance, rather than slipping into recession, the U.S. economy showed surprisingly strong gross domestic product (GDP) growth. Generally modest expectations for the stock market turned into a roaring surge of the S&P 500, and inflation declined to about 3.4%.

Americans also benefited in 2023 from the tail end of federal stimulus and personal savings that exceeded normal balances, but which is tapering off.

At a recent webinar titled 2024-2026 Economic Outlook, AMG’s experts summarized the past year and discussed our outlook for the next three years regarding the Federal Reserve (Fed) and interest rates, inflation, economic growth or softening, and opportunities for investment and risk management. The event featured insight from AMG Chairman Earl Wright; Dr. Michael Bergmann, Chief Investment Officer; Dr. Jarek Strzalkowski, Global Macro Economist; Josh Stevens, Senior Vice President, Investment Group; and Chris Jacoby, Senior Vice President, Private Capital.

AMG’s view is that the economy is most likely to experience a slow start in 2024 before momentum picks up in 2025.

2023: MONEY RUMBLING AROUND IN ECONOMY

Looking back at 2023, Mr. Wright said the economy’s surprising strength was due in part to the fact that we were still “awash with cash” from several trillion dollars in pandemic-era stimulus funds channeled to individuals, businesses, and state and local governments. “That’s a lot of money rumbling around in the economy. And we got the benefit of it.”

The service sector also played a significant role as pent-up demand during the pandemic—when people could not do as much—was released through activities such as leisure, education, healthcare, and entertainment.

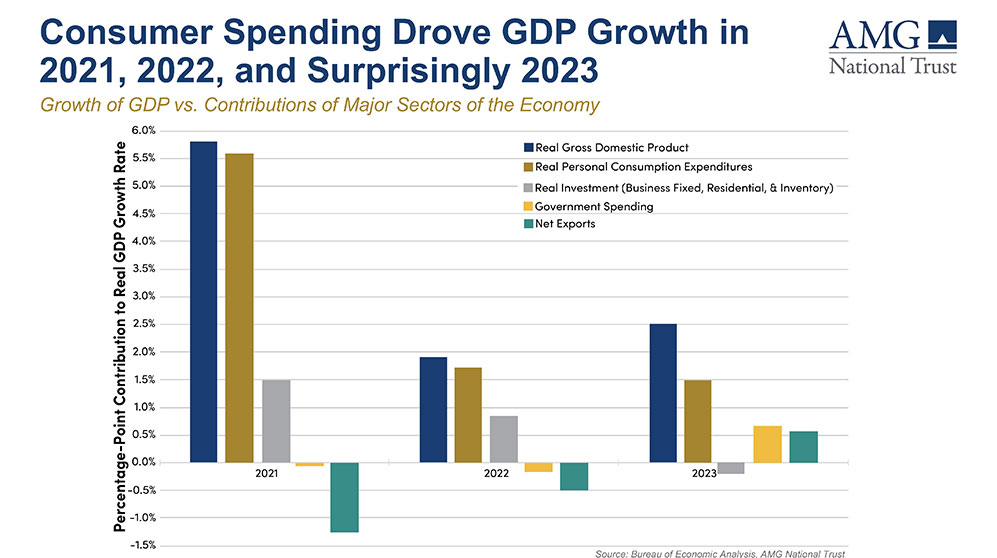

Consumer spending was a growth driver

A strong recovery in 2021 after the pandemic gave way to moderation in 2022. “Surprisingly, growth picked up again in 2023,” particularly in the third and fourth quarters.

Consumer spending was the most obvious direct driver of growth in 2021-2022, with an increase that was about 50% larger than the consensus forecast. For other sectors, total investment was weak in 2023, but the impact of government purchases on GDP growth was about twice AMG’s projections due to the accelerated timing of spending under previous federal stimulus. Also, the always volatile net exports sector added about two-tenths of a percentage point more than projected.

Mr. Wright’s closing question: “Can that raging growth in GDP continue into 2024, or do we have some people who are throwing an anchor into the water to slow us down?”

Good Reason to Be Cautious

Amid these upbeat notes from 2023, the economy faces some real headwinds going into 2024, Dr. Bergmann said, and there’s “good reason to be cautious about the potential for growth and the returns to investment portfolios.”

Excess savings are vanishing. “Consider that consumer spending, the main engine of post-pandemic growth, has likely used up much, if not all, the $2.1 trillion of accumulated excess savings.”

Deterioration in labor market conditions. The labor market, with a low unemployment rate of 3.7%, is now only slightly off its 54-year low of 3.4%, and it is currently still very favorable for workers, Dr. Bergmann said. Conditions seem to be on the march toward less favorable territory.

For example, unfilled job openings are down by more than 3 million over the last two years. This has had an impact on workers’ confidence about their employability, which is shown by a substantial drop in voluntary job quits over the same time period.

Other non-headline data show a similar deterioration:

- Job hiring rate

- Surveys of labor demand or hiring intentions

- Number of temporary workers

- Average weekly hours worked

- Atlanta Fed’s Wage Growth Tracker

Fed policy. Rates were lifted 5.25 percentage points, from March 2022 through July 2023. “Consensus is that the next move will be down, not up,” Dr. Bergmann said, though policymakers appear to be in no hurry to lower them.

At its current high level, the federal funds rate is clearly contractionary, Dr. Bergmann said. Further, the impact of shifts in monetary policy typically take effect with long and variable lags. So, the Fed’s actions in 2023 have most likely not yet imposed their full restraining impact on the economy.

In addition, Dr. Bergmann said, the Fed hasn’t really stopped tightening. It has reduced the size of its balance sheet by about 12% since last April, and it continues to shrink to the tune of $95 billion per month.

As a result, both the broad money supply (M2) and the narrow money supply (M1) are well off their peaks, and liquidity in the U.S. banking system is shrinking. That has increased caution among bankers and led to a virtual hiatus in the growth of bank lending for commercial and industrial activities.

Seven Scenarios for the Next Three Years

These headwinds figure into the outlook for economic performance, asset class risk and returns, and investment portfolios. Dr. Strzalkowski went over the first three scenarios, but all seven scenarios are explained in greater detail here.

The most likely turn of events is designated as our base case scenario. The others, which we still deem to be distinct risks, even if not the most likely turn of events, we designate as alternative scenarios.

AMG’s seven scenarios, starting with what we believe is the most likely, are:

- A Slow Start (base case)

- High Productivity Growth

- Inflation Reaccelerates

- Stubborn Inflation

- Hard Landing

- Crisis in China

- Low Growth Potential

All seven scenarios are explained in greater detail through the link above, but Dr. Strzalkowski went over the first three.

A Slow Start

In our view, the U.S. economy experiences a significant slowdown (or a mild recession) in the first half of 2024. The slowdown is broad-based, with consumer spending and business and residential investment weak across the board.

“If there is a silver lining, it’s that a weaker economy helps bring inflation down to the Fed’s 2.0% target,” Dr. Strzalkowski said, and the Fed begins cutting rates mid-year, with the end point around 3.0%.

The economy recovers toward the end of 2024 and returns to potential in 2025.

High Productivity Growth

This is an optimistic view. Similar to our base case, GDP growth slows in 2024. Productivity growth accelerates in late 2024 and into 2025, driven by broader implementation of artificial intelligence (AI) and favorable regulation and government policy. Increased productivity leads to faster actual and potential growth in the economy. The efficiency gains help keep inflation under control in 2025.

Inflation Reaccelerates

In this somewhat negative scenario, inflation continues to fall in the first half of 2024, approaching the Fed’s 2.0% target. The economy continues to perform well, and the labor market remains tight. The progress on inflation leads the Fed to cut rates around mid-2024. The economic growth accelerates in the second half of 2024, but so does inflation, fueled by wage growth coming from the continuously tight labor markets. The Fed is forced to reverse course and hike rates in 2025, slowing down the economy later that year.

SOME POSITIVES IN 2-YEAR EXPECTED RETURNS

Those three scenarios also impact 2-year annualized, expected pre-tax return estimates.

Among the factors affecting potential returns, Dr. Bergmann pointed to a number of tailwinds among fixed income classes: Current interest payments are relatively attractive and market rates are likely to fall in the future, which can create capital appreciation.

He warned, though, that this effect is not uniform, such as for tax-exempt bonds and high-yield securities.

Among equities, slow economic growth may well be a drag on corporate profits in the near term, “but down the road just a bit that should reverse as profit margins are aided by recovery in the economy, slower inflation and lower financing costs,” Dr. Bergmann said.

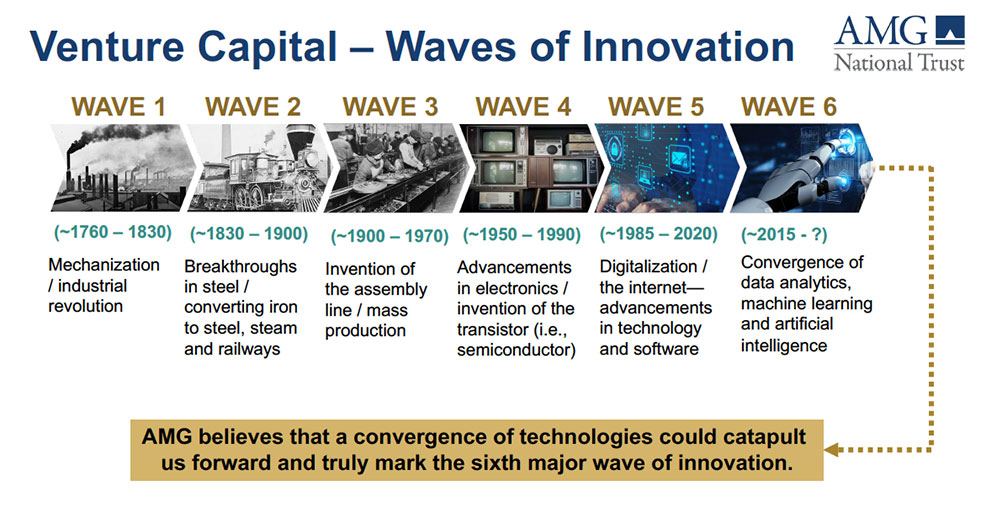

Venture capital investors likely will benefit from a continuing upward cycle of innovation and a drop in the near-term availability of investor capital for startups and early follow-on financing rounds.

Prospects Amid Small-cap and Foreign Stocks

Wall Street appears to believe earnings will grow 11% to 13% for the next several years. AMG, however, anticipates there is more likely to be a “flattish” scenario for earnings in 2024 before an acceleration in 2025.

Amid high earnings growth expectations and high price-to-earnings ratios, Mr. Stevens said the risk-reward has dimmed somewhat for domestic or large-cap stocks. This doesn’t suggest selling large cap, but at the same time, this isn’t necessarily the best risk/reward to be adding to that large-cap position.

In small-cap and foreign stocks, he added, there appears to be more favorable risk/reward. The expected volatility in 2024 may provide opportunities to selectively build equity positions for 2025 and beyond.

Staying diversified across different asset classes certainly makes sense over the next couple of years, he said.

Mr. Stevens suggested that small cap and global value are likely where AMG expects to see acceleration in 2025 and beyond.

Private Capital: Energy, AI, and Multifamily

Using the scenarios as a guidepost when looking at private capital investments, AMG has identified several potential opportunities in the illiquid, alternatives space across multiple asset classes.

Energy

AMG sees economic conditions supportive of returns from oil and natural gas, Mr. Jacoby said. Rig counts remain low, and the increase in production is largely driven by the completion of previously drilled but uncompleted wells, known as DUCs. As that inventory starts to diminish, supply could become more restrained, at least in the U.S., and remain supportive of pricing.

Meanwhile, exports of liquid natural gas (LNG) are increasing, and the U.S. is now the world’s largest exporter. The Biden administration recently announced restrictions on the development of new LNG terminals, and that will need to be factored in, but current construction of LNG facilities is expected to increase capacity well into 2030.

“Ultimately, we believe the transition to clean energy demands a shift to natural gas to continue the displacement of coal inputs, particularly in emerging markets and in Asia,” Mr. Jacoby said. “So, we believe that energy royalties continue to offer an attractive way to gain exposure to the commodity while limiting risk of drilling and drilling activities.”

Venture capital

AI, currently utilized in large language models and search engines, is still in its early days but a convergence of next-stage technologies could catapult us forward to the next big wave of innovation.

A large unknown for investors is the number of vertical applications that may grow out of AI, and how those will impact industries. But we can use our imagination to point out the potential, Mr. Jacoby said. For instance, in health care, we’re already seeing advanced medicines and targeted therapeutics. In industrial manufacturing, we’re seeing synthetic biology displacing petroleum inputs for chemicals, polymers, and advanced materials.

Real estate

AMG’s focus is on multifamily. Opportunities appear mixed with commercial real estate for retail and industrial properties.

In multifamily, several long-term factors support our view: There is consistent demand for housing but also a shortage of at least three to five million units in the United States. In addition, the monthly debt service to purchase a median single-family home has increased dramatically, and while median rents generally have also increased, the amounts have trailed the cost to buy. The outcome is that more people may be driven to rent.

There are short-term considerations that will impact valuations. For example, delivery of new units is starting to pressure occupancies, which can soften rent growth. However, leading indicators for construction signal some new projects are being sidelined and over the next 12 to 24 months, the pressure of new units coming to market should abate.

OUTLOOK NOT DOUR AMID HEADWINDS

From among the considerations discussed in the webinar, AMG expects investors will be able to find opportunities in the 2024-2026 economic environment. Though they may face some headwinds—such as navigating the Fed, a softening labor market, and lower excess savings being available for spending—these should not be insurmountable, particularly if, as we expect, momentum picks up in 2025.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.