Webinar: AMG’s 2023-2025 Economic Outlook

• 4 min read

- Brief: Global Economy

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.

"*" indicates required fields

America’s economy is slowing down and likely headed for a mild recession this year, suggesting that investors should consider boosting their bond holdings.

“We are not all that positive about the economy for the next couple of years,” said AMG Chairman Earl Wright. “We’re in a period of transition … but there are some opportunities … and we should be in a pretty good position on the other side.”

AMG released its new Three-Year (2023-2025) Economic Outlook during a Jan. 25 webinar. The forecast contains seven distinct paths the domestic economy could take in coming years, with none expecting much growth. The Base Case, or mostly likely scenario, anticipates flatline economic growth with a mild recession or severe slowdown this year, followed by annual growth of 1-2% in 2024-2025.

CLICK HERE TO WATCH THE WEBINAR

Inflation, rising interest rates and a slow, lingering recovery from the COVID-19 pandemic elsewhere worldwide, along with other international factors such as the Ukraine War and China’s economic slowdown, are working to hinder U.S. growth and keep stock markets bearish.

“Note that high interest rates, high costs and slow growth suggest a strong headwind for equities, but a tailwind for bonds,” said Dr. Michael Bergmann, AMG’s chief economist and investment officer. “This is the first time in 30 years that I’ve been doing this [Economic Outlook scenarios] that bonds are expected to outperform equities.”

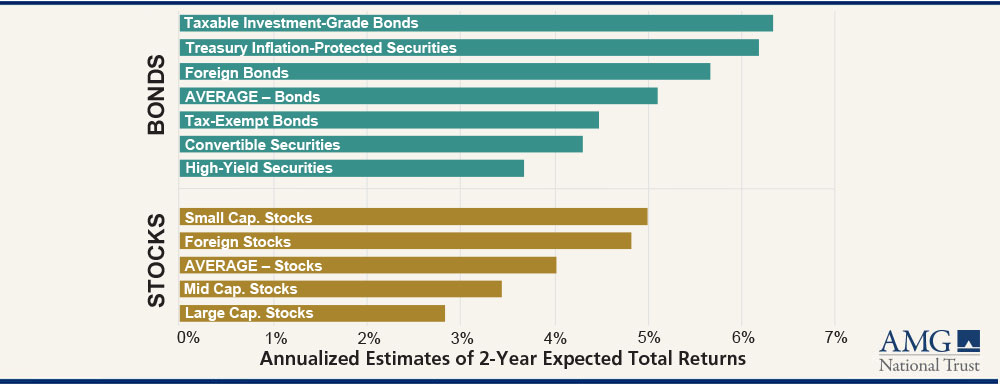

Bond returns during the forecast are expected to exceed the average stocks returns.

Base Case Expected Returns—Bonds vs. Stocks

The average of unweighted expected returns for bond asset classes is 5.1%; for stock asset classes, it is 4%. The contrast is even bigger when comparing the two most popular and widely recognized asset classes. Taxable investment-grade bonds are expected to provide a return of 6.3%, whereas large-capitalization stocks only 2.8%.

“Investors might want to take their excess cash and put it into short- and mid-term fixed-income securities,” said Josh Stevens, AMG’s senior vice president of AMG Capital Management.

Bergmann suggested that even relatively aggressive investors should consider increasing their bond holdings.

While bonds are relatively attractive vs. stocks, “Don’t bet the farm on fixed income,” Stevens warned. Historically, bullish bond markets last just six to 24 months. “Eventually the bear stock market will end,” and investors don’t want to miss the recovery.

Stevens said AMG expects stock market returns to be relatively flat for the next two years. He pointed out that value stocks that pay dividends might provide returns similar to investment-grade bonds. He also said select foreign stocks might offer opportunities since the value of the dollar seems to have peaked.

Chris Jacoby, AMG’s senior vice president of private capital, described several other potential investment opportunities that might arise during this economic slowdown:

- Energy as part of a broader natural-resources strategy in both private and public markets. Oil prices have moved up over the past two years, but exploration and drilling have not. Proven reserves are in decline. That means economic recovery and any geopolitical events, such as the Ukraine War and Russian oil embargo, will likely drive prices higher, providing investment returns. Renewable energy is part of this strategy as well, but efforts to transition away from carbon-based fuels will take time.

- Real estate. America is experiencing a substantial underinvestment in housing right now. Home prices jumped significantly over the past two years, and interest rates have surged since April (a 30-year fixed mortgage went from 2.8% to well over 7%). An estimated five million homes are needed, but many would-be buyers are priced out of the market, meaning they will turn to for-rent housing, including multi-family units.

- Venture Capital. A substantial over-investment occurred in this sector in recent years, yet deal value and activity is now declining as the frenzy has come out of the market. The tech sector is laying off tens of thousands of workers, which typically spurs the next generation of start-ups and innovation. AMG is seeing many new companies using novel biological processes that are both sustainable and economically viable, spurring a reindustrialization across chemicals and advanced materials.

While astute investors will find opportunities in coming months, America’s economic sails likely won’t catch a breeze and return to more favorable seas until inflation is subdued and interest rates start to come down. AMG doesn’t expect that to start happening until 2025.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.