2026-2028 Economic Outlook: Muddling Through

• 7 min read

Get the Latest Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

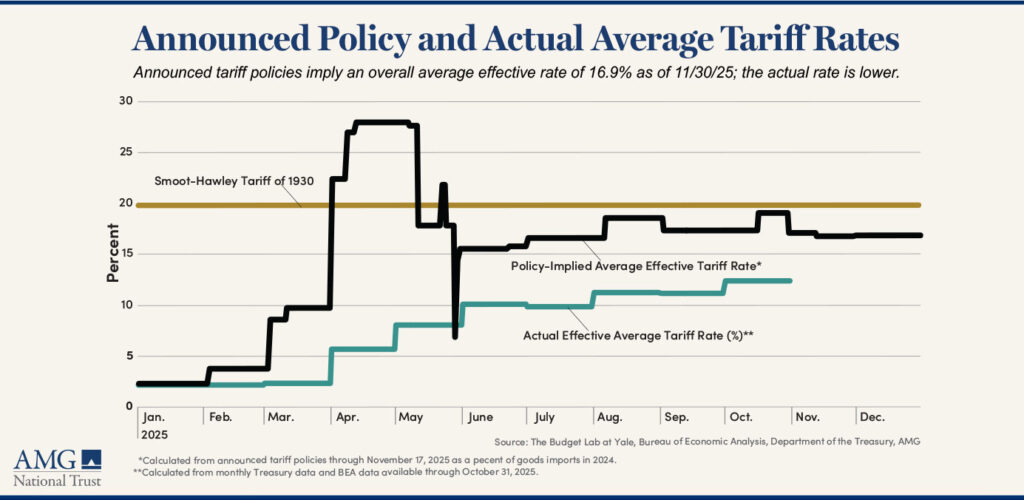

Tariffs and the uncertainty around them dominated the outlook for 2025. However, the economy did grow—if in a disjointed fashion—inflation was steady to modestly downward, and unemployment was stable.

To discuss expected economic scenarios and potential opportunities for 2026, AMG held a webinar to release its 2026-2028 Economic Outlook with insight from Chairman Earl Wright; Dr. Michael Bergmann, Chief Investment Officer; Dr. Jarek Strzalkowski, Global Macro Economist; Josh Stevens, Senior Vice President, AMG Capital Management; and Chris Jacoby, Senior Vice President, Private Capital.

“Muddling Through” is AMG’s base case, or most likely scenario, and anticipates the economic slowdown ending this year due to interest rate cuts and fiscal support from the One Big Beautiful Bill Act (OBBBA). Gradually increasing investment in data centers should also help the economy grow at a rate close to potential.

A more positive scenario, “AI Boom,” anticipates significant waves of innovation from artificial intelligence (AI), higher GDP growth, and job creation more than offsetting jobs displacement. A third, less rosy scenario, “Dovish Fed,” envisions an aggressive interest rate easing cycle in 2026 that unleashes faster growth and booming asset prices. However, inflation returns, eventually forcing policymakers to aggressively tighten policy in early 2027, pushing the economy into a mild recession.

2025 GROWTH WAS ELEVATED AND ERRATIC

In setting the stage for 2026 projections, Dr. Bergmann first provided some background on the past year, saying that economic growth appears to have been elevated and highly erratic and occurred as households and businesses purchased goods in advance of anticipated increase in tariffs.

The effects of “front running,” he added, were particularly notable during the fourth quarter of 2024 through the second quarter of 2025.

Also, the expected impact of tariffs was lessened somewhat and did not “crash” real GDP for a number of reasons, Dr. Bergmann said: Tariffs were implemented neither immediately nor uniformly; the economy is not static and businesses responded by trying to mitigate adverse impacts, such as by not passing costs on to consumers or rerouting supply chains; and a strong AI capital expenditure (capex) boom helped boost domestic demand.

FACTORS THAT BEAR MONITORING

Although inflation is still running above the Federal Reserve’s (Fed) 2% target, further rate cuts could be likely, Dr. Strzalkowski said. While the impact of tariffs on inflation is thought to be behind us, some of those costs could still wind up being passed on to consumers. Even if inflation does come down, consumers may doubt that it is actually happening because they have been scarred by four years of higher inflation.

Another factor that bears monitoring, Dr. Strzalkowski said, began in 2021-2022 with a reshuffling of the labor market as jobs shifted and employees changed employers. “It might have resulted in actually quite significant productivity gains, (with) people being better matched to their jobs.”

That was followed by a gradual cooling period referred to as the “no-hire, no-fire” labor market that led to a gradual increase in the unemployment rate of 4.4%. That number by itself is not something to panic about because it’s still historically low. The concern, though, is that the increase has lasted an unusually long three years and “we wouldn’t want this deterioration to continue,” he added.

IMMIGRATION AND ECONOMIC GROWTH

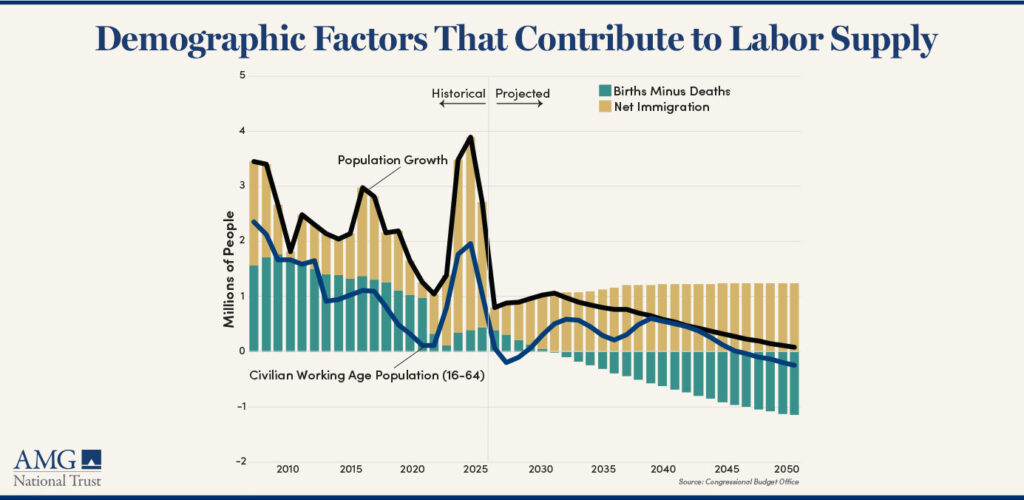

The sharp decrease in immigration in the last year stands in stark contrast to the previous three years where immigration drove a significant increase in the U.S. labor force.

This could be concerning because it intersects with Congressional Budget Office (CBO) projections showing that in 2031, deaths in the United States will surpass the number of births, resulting in a subsequent decline in the working age population and likely affecting economic growth. The CBO included a potential solution: By accepting about 1 million immigrants a year, the net negative demographic change could be delayed by some 20 years.

FISCAL POLICIES ALSO PROVIDE BENEFITS

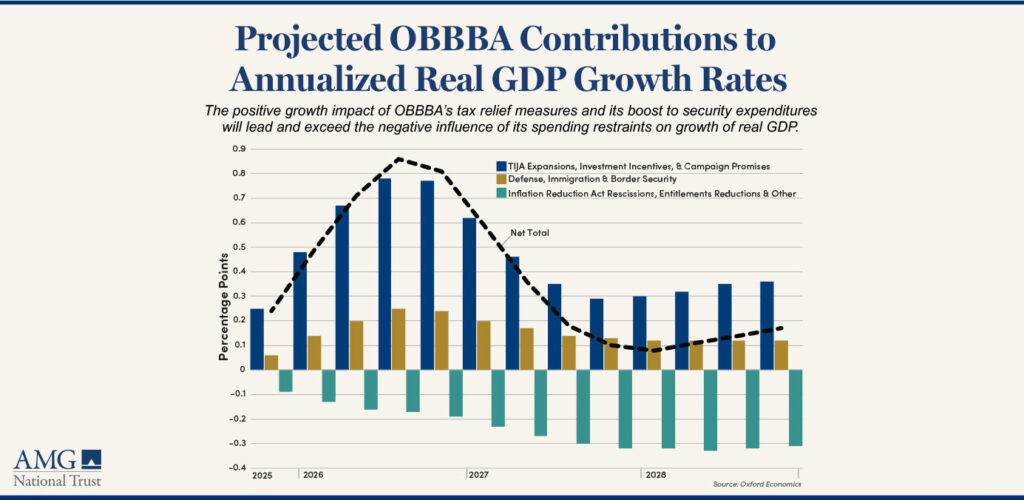

Fiscal stimulus such as the OBBBA also could help temper the unemployment numbers. Dr. Bergmann said the OBBBA “has definitely set the fiscal policy dial to expansionary in the near term.”

The OBBBA renewed and extended the tax cuts in Tax Cuts and Jobs Act, boosted spending for defense and border security, and increased investment incentives, among other things. It also included rescissions to spending that was approved in the Inflation Reduction Act of 2022.

“The net positive impact is indeed something that will help support our base case,” Dr. Bergmann said.

But just as the OBBBA removed spending priorities from a previous administration, a similar fate for the OBBBA is only an election away, he added.

RESURGENCE IN TRADITIONAL ECONOMY

AMG expects that the fiscal (the OBBBA is geared toward reindustrialization), and monetary (recent rate cuts) policy backdrop has created a cyclical earnings growth opportunity. The fiscal and monetary policy dynamic is both domestic and foreign, with many foreign policy makers taking action to spur growth.

“We’re likely to see some re-acceleration in the traditional economy, in industrials and materials and financials … creating opportunity for small, mid, and foreign stocks to outperform large cap over the next couple of years”, Mr. Stevens said.

AMG is not suggesting that investors should exit U.S. large-cap stocks. Rather, AMG’s base case anticipates other areas of the stock market to perform better because of the policy backdrop. The environment of the next couple of years presents the opportunity to rebalance and diversify portfolios into cheaper stocks with strong fundamental upside.

ALTERNATIVE INVESTMENTS

Opportunities in alternative investments also can help diversify portfolios. Mr. Jacoby said.

Venture Capital

AI is catapulting the next wave of innovation. Applications in biological research are just an example, but the impact is being felt across multiple industries. For instance, AI is driving demands for power management and new power sources, such as fusion technology. Beyond AI, companies are also innovating around rocket technologies, satellite communications, and re-envisioning navigational systems. However, the expansion of AI brings with it concerns about how to enhance cybersecurity.

Amid this innovation wave, Mr. Jacoby said, the amount of capital committed to venture capital declined about 44% from 2024 to 2025, creating an investor-friendly environment. The reasoning is that as capital becomes more scarce, the opportunity to drive returns can be greater.

Investment Real Estate

After struggling in the wake of COVID-19, commercial real estate seems to be normalizing with momentum building into 2026. Vacancy rates for office space have begun to stabilize, though it’s likely still too early to invest. Physical retail space remains resilient amid competition from ecommerce.

Turning to the industrial side, the rethinking of supply chains and industrial demand have spurred some development, including for data centers.

Multifamily is moving through a short-term slowdown as construction activity has delivered a significant number of new units to the market. However, the number of starts and permits—both forward-looking indicators—have declined dramatically, suggesting development activity is declining, perhaps over the next two to three years. Demand drivers remain in place, which should allow for a recovery in vacancy rates and a return to rent growth.

Energy

The market for liquefied natural gas is expanding and expected to push prices higher. Demand from Europe, South Korea, Japan, and elsewhere is primarily behind the outlook for a significant increase in U.S. exports of natural gas over the next two years. In addition, Mexico’s import of natural gas has increased dramatically over the past 20 years. The United States should be more than able to meet rising demand because proven natural gas reserves have grown more than threefold since the early 2000s.

MAINTAIN A WELL-DIVERSIFIED PORTFOLIO

AMG’s takeaway for investors, Dr. Bergmann said, remains maintaining a well-diversified portfolio that conforms to the risk limits of the investor.

That can begin with bonds, which are likely to provide moderate positive returns over the next several years. In AMG’s base case and next two most likely scenarios, the expected return for stocks are slightly better; the potential for even higher returns exists in several alternative investments, such as venture capital and investment real estate.

HOW AMG CAN HELP

Not a client? Find out more about AMG’s Personal Financial Management (PFM) or to book a free consultation call 303-486-1475 or email us the best day and time to reach you.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.