Turtles or Hares? Who Wins in 2026?

• 3 min read

Get the Latest Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

QUESTION: What should I be thinking about doing with my investments this year?

ANSWER: Start by looking at where you’ve been and how you got here before deciding where to go next.

By most measures, 2025 was a good year for markets. The Magnificent Seven tech stocks and other companies at the forefront of the artificial-intelligence (AI) boom drove much of the market’s gains. Growth-oriented indexes were up more than 20% last year, largely because those stocks dominated their weightings. The S&P 500 was also up nearly 20%; some 40% of its value is concentrated in these businesses.

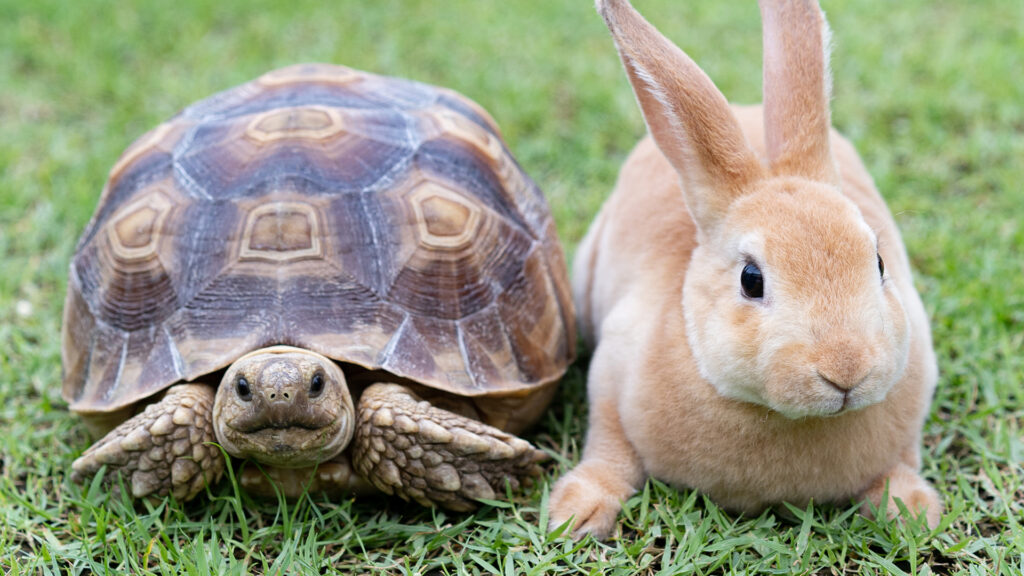

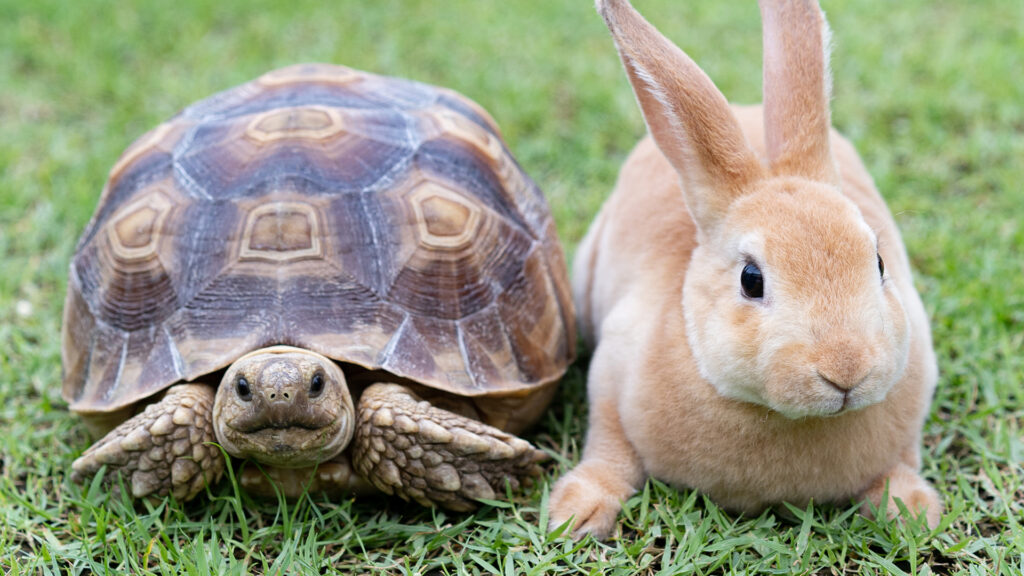

By comparison, anything not tied to AI looked like a turtle racing against a field of hares. Still, those turtles have posted respectable gains of around 13%.

AI-related stocks’ extraordinary rise has raised concerns among some investors that a market bubble is forming, and they wonder whether it will soon pop. Supporting that idea are the massive capital expenditures (CapEx) on AI despite what appears to be a slowing U.S. economy. On the other hand, that ebbing economy is also nudging America into a period of lower interest rates, which typically supports stock valuations. A more important consideration, however, is that CapEx market rallies like this one tend to last far longer than seems reasonable and then end with little to no warning.

In short, there’s no way to know when, or even if, this AI-driven rally will end. All we can say is that it’s risky right now.

Here are three tips:

Don’t fall in love with your tech and growth stocks. While their outperformance could continue, it’s just as likely to end painfully. Taking some profits while they’re available might make sense.

Don’t be afraid of recent underperformers. Today’s turtles might beat the hares in 2026. Stocks unrelated to AI appear reasonably valued and already reflect a slower-growth environment. If enthusiasm around AI cools, these less glamorous parts of the market may hold up relatively well and could be positioned for stronger returns later in the year as the economy stabilizes and earnings growth resumes in a lower-rate environment.

Stay diversified. AMG’s current investment themes—small-cap value (undervalued companies that generate real earnings), natural resources, and foreign stocks—continue to look attractive. These areas can provide both risk mitigation and return potential in an uncertain economic and market environment.

HOW AMG CAN HELP

Not a client? Find out more about AMG’s Personal Financial Management (PFM) or to book a free consultation call 303-486-1475 or email us the best day and time to reach you.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.