U.S. Labor Force Growth and the Impact of Public Policy

• 25 min read

- Brief: Banking, Community & News, Global Economy

Get the latest in Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

EXECUTIVE SUMMARY

Official government projections for potential GDP—a measure of the maximum sustainable output of the U.S. economy—have declined significantly since 2007. The U.S. Federal Reserve (Fed) closely monitors the gap between potential GDP and actual GDP in deciding how quickly to raise interest rates, and the decline in U.S. potential GDP estimates since 2007 could lead the Fed to raise interest rates more rapidly than would otherwise be the case.

Shrinking labor force growth has played an important role in the slowdown of potential GDP, and a rebound in labor force growth could also help reverse the trend. Much of the deceleration in labor force growth since 2007 is attributable to an increase in retirements, though cyclical factors like higher disability claims and school enrollment continue to have a major impact. Many cyclical factors have begun to reverse in recent years as the labor market has tightened. Recent recoveries in labor force participation for key demographics and the continued rise of unfilled job openings in the United States suggest that the strong U.S. labor market is pulling workers back into the labor force, and that labor force participation may be overdue for a rebound.

Public policy can also play a role in stimulating labor force growth. Initiatives that target labor force participation for key demographics such as women, prime-age men and those in poverty could have a significant positive impact. Though some potential policy avenues are more feasible than others, there are numerous opportunities for public policymakers to encourage higher labor force growth.

Rough estimates suggest that an increase in labor force growth on the heels of a cyclical labor market rebound or public policy support could meaningfully improve growth in potential GDP. Such an improvement could indicate to the Fed that the economy has more room to grow before overheating, and might slow the pace of the Fed’s interest rate increases. Such a development would help lengthen the economic cycle, and could also bode well for investors.

THE DECLINE IN LABOR FORCE GROWTH AND POTENTIAL GDP GROWTH

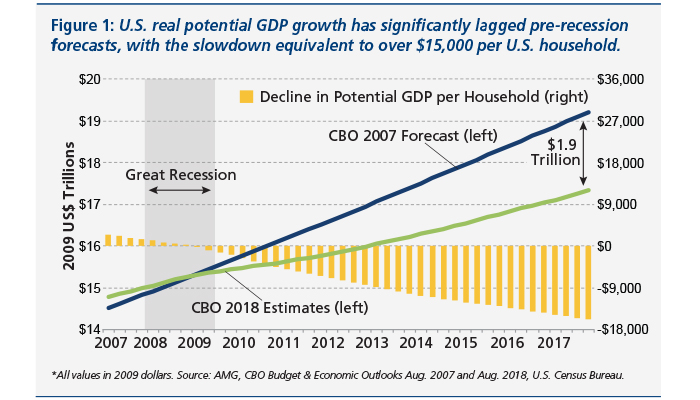

Prior to the start of the Great Recession, the U.S. Congressional Budget Office (CBO) projected that real potential GDP would grow by a healthy 2.6% per year between 2007 and the end of 2017. According to CBO estimates made in 2018, real potential GDP actually grew by less than 1.5% per year over that period.1 The slowdown in real potential GDP as estimated by the CBO has been significant, amounting to $1.9 trillion as of the end of 2017, or over $15 thousand per U.S. household (Figure 1).

The CBO’s estimates of potential GDP reflect its view on the long-term potential output of the U.S. economy, based on its forecasts for the potential size and productivity of the U.S. labor force.2 The reduction in potential GDP since 2007 means the U.S. economy has less room to grow before it exceeds its estimated sustainable capacity. When the economy exceeds its estimated capacity, the Fed is forced to raise interest rates, putting the brakes on future economic growth. Thus, a rebound in potential GDP would have the opposite effect, giving the economy more space to grow before overheating.

What has been responsible for the dramatic slowdown in U.S. potential GDP growth since 2007? Has the Great Recession fundamentally changed the trajectory of the U.S. economy, or permanently impaired long-term growth? One explanation may lie in how potential GDP is estimated. Research suggests the potential GDP methodologies used by the CBO and other prominent forecasters tend to overstate the long-term impact of temporary labor demand shocks, such as those caused by the Great Recession.3 This means U.S. potential GDP may have declined less than the CBO projects, as recent estimates have been skewed downward by cyclical, or temporary, impacts from the Great Recession.

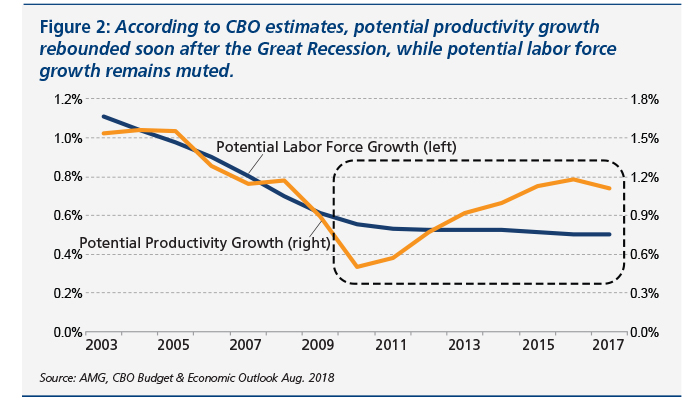

As mentioned, there are two primary components to estimates of potential GDP: potential labor force and potential productivity. Growth in potential GDP is roughly equal to the sum of potential labor force growth and potential productivity growth. As Figure 2 shows, the deceleration in potential GDP growth since 2007 has been a result of slowdowns in both components. Potential productivity growth declined sharply during the recession and has since rebounded to near pre-recession levels, while potential labor force growth fell during the recession and has yet to recover.

Given that potential labor force growth has not recovered in the same way as potential productivity growth, potential labor force growth may still have the opportunity for a cyclical rebound. Further, labor force growth might be more readily addressed by efforts from public policymakers than productivity growth, as public policies can directly create jobs and demand for labor. The impacts of public policies on labor force growth may also be easier to quantify, as labor numbers are reported monthly, while most productivity measures are reported only quarterly or annually.

In light of these factors, this report focuses specifically on the labor force component of potential GDP growth. The following sections consider why U.S. labor force growth has slowed and explore how cyclical labor force improvements and public policies could lead to a reacceleration. Later sections estimate the impact higher labor force growth could have on potential GDP growth and the U.S. economy, and discuss potential implications for investors.

KEY COMPONENTS OF THE LABOR FORCE GROWTH SLOWDOWN

The civilian labor force as defined by the Bureau of Labor Statistics (BLS) is the product of the civilian non-institutional population—the number of people in the United States above the age of 16 not incarcerated, institutionalized or in the active armed forces—and the civilian labor force participation rate (LFPR)—the percentage of the civilian non-institutional population that is either employed or actively looking for work. As a result, the size of the labor force can be impacted either by changes in the civilian population, changes in the LFPR or both.

Growth in the civilian non-institutional population has decelerated modestly since the Great Recession, declining from an average of 1.3% in the economic expansion of the early to mid-2000s to 1.0% during the most recent expansion.4 However, because civilian population growth depends on national birth rates, death rates and net migration, it generally is less impacted than the LFPR by temporary or recession-driven factors.

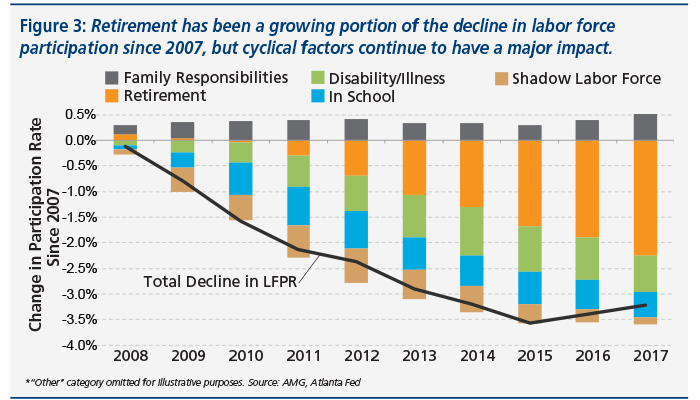

Similar to potential GDP, the LFPR has declined significantly from its pre-recession forecasts. According to estimates from the Federal Reserve Bank of Atlanta (Atlanta Fed), the LFPR declined by just over 3.2% from 2007 to 2017, the equivalent of about 8.2 million workers.5 As of 2017, about two-thirds of this decline was attributable to retirements and about one-third was attributable to cyclical factors like increased disability insurance claims, additional schooling and elevated levels of shadow labor6 (Figure 3). However, the Atlanta Fed’s estimates also suggest that a portion of the retirements since the Great Recession may have been cyclically and behaviorally-driven rather than demographically-driven.7

Other research has come to similar conclusions. A 2014 study from the Obama administration found that the unexplained residual decline in the LFPR since the Great Recession was largely attributable to higher levels of disability, increased schooling and elevated levels of long-term unemployment.8 Many potential laborers also simply became discouraged after the Great Recession and stopped looking for work.

The commonality among many of the factors driving the LFPR decline is that they are not permanent changes to the U.S. economy, but rather lingering cyclical effects from the Great Recession. Therefore, if the U.S. economy continues to expand and the U.S. labor market remains healthy, many of the factors weighing on participation could dissipate and some may even reverse.

OUTLOOK FOR U.S. LABOR FORCE PARTICIPATION

The strength of the U.S. labor market in recent years appears to have already had a positive impact on the LFPR. The aggregate LFPR bottomed in September 2015 at 62.3%, and in the years since has stabilized and regained some ground to the July 2018 level of 62.9%.9

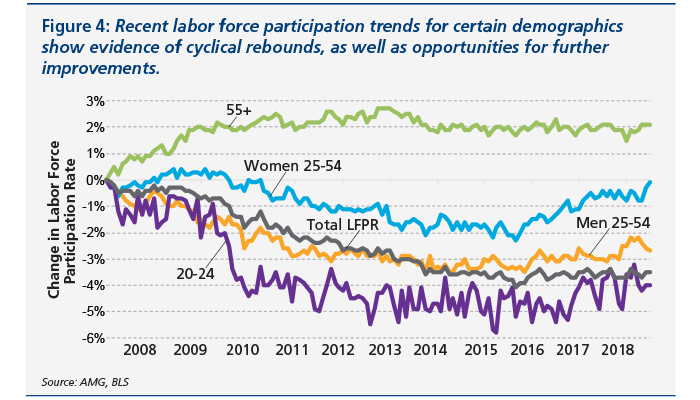

Certain demographics have experienced an even more pronounced rebound in labor force participation. The LFPR for “prime-age” women between the ages of 25 and 54, for example, declined by 2% from 2007 through 2015, but has since rebounded to pre-recession levels. The LFPR for prime-age men declined by nearly 3.5% from 2007 through 2015, but has since recovered by nearly 1%. And the LFPR for young people between the ages of 20 and 24 declined by over 6% after the recession, but has also rebounded by about 2% in recent years (Figure 4).

Rebounds in the prime-age and youth participation rates likely signify that the U.S. labor market has passed a turning point, a point at which demand for labor has become strong enough to begin attracting discouraged workers, students and other labor market non-participants back into the labor force. Further, given that the recoveries in these LFPR measures have been modest to date, the participation rates for many demographic groups may still have room for improvement.

Participation rates for older workers display a different trend. For one, the LFPR for people over the age of 55 actually increased by about 2% between 2007 and the end of the Great Recession. This could be the result of improving health for older workers, an increase in less-physically demanding occupations, or the need for older persons to temporarily return to the workforce to pad their retirement savings. The LFPR for those over the age of 55 has also been largely stagnant since 2009, and has not seen the same rebound as the participation rates of other cohorts in recent years.

As the U.S. labor market continues to tighten—meaning there are fewer available workers in the labor force relative to the number of job openings—the participation rates for prime-age workers, young workers and even older workers may increase. Not only will job availability and average pay improve, encouraging higher labor force participation from all demographic groups, but there is a strong historical relationship between the number of unfilled jobs in the U.S. economy and the overall participation rate.

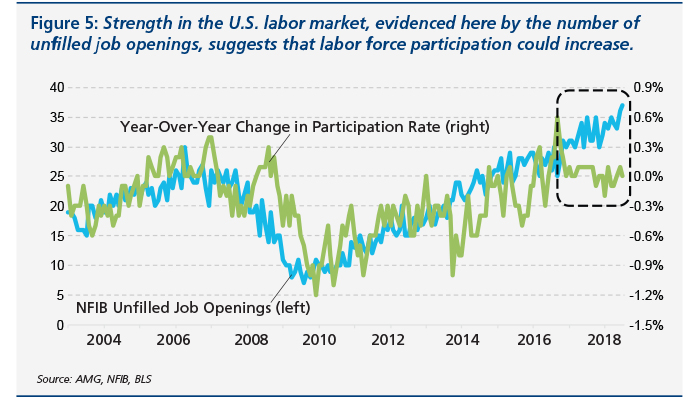

As Figure 5 illustrates, the national index of unfilled job openings as reported by the National Federation of Independent Businesses (NFIB) has a strong historical relationship with year-over-year changes in the LFPR. In July 2018, unfilled job openings reached the highest level on record in data going back to 1986, and suggest that overall labor force participation may be overdue for a rebound.

POTENTIAL IMPACTS FROM PUBLIC POLICY

While labor market strength has supported the LFPR in recent years, the ongoing aging of the U.S. population presents a significant long-term headwind to overall labor force growth. For higher labor force growth to extend beyond the current economic expansion, support from public policy may be necessary.

The following sub-sections identify key labor force demographics that public policymakers might target to encourage higher population growth or labor force participation. Each sub-section explores policy avenues that policymakers could use to achieve higher growth or participation for the demographic in question, and estimates the potential costs and benefits to labor force growth where possible.

Immigrants

Legal immigration to the United States slowed for a time after the Great Recession before rebounding in recent years, though the roughly 1.2 million legal immigrants permitted in 2016 remains well below the historical high of 1.8 million permitted in 1991.10 The federal government could encourage more immigration by relaxing its permanent or temporary immigration quotas, though a focus on employment-based quotas, such as H-1B visas, might be most effective in stimulating labor force growth. In the current political environment it may be unfeasible for the United States to relax immigration policies. However, for sake of example, if legal U.S. immigration was permitted to return to the highs of 1991, population growth would increase by about 600,000 per year compared to 2016 levels. Recent historical data suggest that approximately 64% of U.S. immigrants are employed,11,12 meaning that the addition of 600,000 immigrants each year could translate to roughly 380,000 new workers per year, or additional labor force growth of about 0.25% per year.13

Impoverished

Impoverished Americans are among the most disenfranchised in terms of economic mobility, and also among the least likely to participate in the labor force. A recent study found that just 45% of working-age Americans in poverty were participating in the U.S. labor force in 2014,14 compared to a national average of about 63%.15 Many proposals have been put forth to encourage labor force participation among those in poverty. One of the most potentially impactful involves expanding the Earned Income Tax Credit (EITC) for childless adults.

As it currently stands, the EITC—which provides refundable tax credits to people with earnings below a certain threshold who are actively working—offers relatively little support for eligible recipients who do not have children. This creates disincentives for childless adults to enter the labor force relative to those who have children. One recent study concluded that the current EITC policy toward childless adults contributes to 7.5 million childless adults being taxed into poverty or further into poverty each year.16

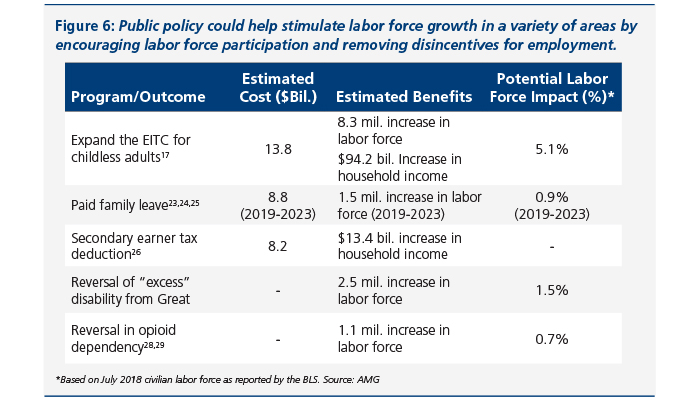

Various changes to the EITC have been proposed in recent years. One of the most prominent was Rep. Paul Ryan’s 2014 proposal to expand the EITC for childless adults, which was similar to a previous proposal put forth by the Obama administration. The plan would double the current EITC credit for eligible childless workers and increase the income levels at which the credit phases out. A study from the American Action Forum estimated that implementing such an EITC expansion would cost $13.8 billion and would increase the employment of childless adults by 8.3 million,17 equivalent to about 5.1% of the July 2018 labor force.

Women

Women have historically played an important role in supporting the U.S. participation rate. Between 1970 and 2000, the aggregate LFPR increased by 6.7% even as the male LFPR declined by 4.9%, a result of an impressive 16.5% increase in the LFPR for women over the same period.18 Since 2000, however, the female LFPR in the United States has declined slightly, while the female LFPR in most other developed countries has continued to rise.19 One prominent example is Japan, where the participation rate for prime-age women increased by roughly 10% between 2000 and 2016, at which point it surpassed that of the United States. Many credit Japan’s generous childcare policies for the improvement, as the country has mandated paid family leave and continued to expand on it over the last several decades.20

This situation is a contrast to that of the United States, where no paid family leave is mandated by the federal government and only 14% of civilian workers had access to paid family leave as of 2016.21 The Trump administration has recently put forth proposals to federally mandate paid family leave, which are estimated to cost about $8.8 billion in the five years from 2019 through 2023.22 Based on estimates that there is a roughly 8% LFPR increase for new mothers one year after childbirth as a result of paid family leave,23 federally mandated paid family leave could result in an additional 1.5 million women in the labor force from 2019 through 2023,24 or an additional 0.9% relative to July 2018 levels.

Another option to encourage higher female labor force participation involves a tax deduction for secondary earners in low and middle-income families. Under current tax law, secondary earners in households—predominately women—suffer an effective average tax rate of 70%, due to a higher starting tax rate and reductions in tax credits and social assistance. By providing a tax deduction for secondary earners in low and middle-income families, potential secondary earners may have more incentive to join the labor force. One such proposal is estimated to cost the government $8.2 billion in lost tax revenue, but could also result in an increase in labor force participation and an additional $13.4 billion of income for low and middle-income families.25

Prime-Age Men

One of the primary explanations for why the LFPR of prime-age men has decreased in recent decades, and particularly since the Great Recession, is the prevalence of prime-age men collecting disability insurance. According to a 2015 study, there were approximately 2.5 million “excess” Social Security Disability Insurance applications filed as a result of the Great Recession.26 If public policies were put in place to more stringently enforce disability eligibility, or to reduce the disincentives of returning to the labor force, it could help to reverse the excess disability claims. Based on the size of the labor force in July 2018, such a reversal would grow the labor force by about 1.5%.

Another important factor in the decline in LFPR for prime-age men is the dramatic rise in opioid dependency in the United States. According to a recent study, close to half of all prime-age men not in the labor force take pain medication daily, and the increase in opioid drug use between 1999 and 2015 may account for a fifth of the decline in the male prime-age LFPR over that period.27 Although by no means an easy avenue for public policymakers, addressing and reversing the opioid crisis could thus add approximately 1.1 million workers to the labor force,28 or an additional 0.7% compared to July 2018 levels. A summary of the costs and benefits of the aforementioned policy options is presented in Figure 6. The values in the table represent the total costs and benefits of each program over time, except in the case of paid family leave, which is evaluated over a five-year period from 2019 through 2023 (see next section).

Less-Educated

According to BLS data, the LFPR for those with a bachelor’s degree or higher was 73.4% in July 2018, versus just 57.6% for those with only a high school diploma. In general, less-educated individuals have a harder time finding work and are far less likely to participate in the labor force than individuals with more education. One potential remedy would be for the government to directly create job opportunities that cater to less-educated individuals. The recent infrastructure proposal from the Trump administration could potentially help; a recent study estimated that 55% of new jobs created by the infrastructure proposal would go to people with high school education or less, and nearly 60% of new jobs created would require no more than six months of on-the-job training for new hires.29

Younger

As discussed in the previous section, participation for young people has declined significantly since the Great Recession, and a significant portion of the decline can be attributed to increased enrollment in higher education. Previous research has suggested that perceived returns to experience vs. education has a significant impact on the LFPR.30 The labor market weakness following the Great Recession made perceived returns to experience appear much lower than perceived returns to education, which helped drive an increase in school enrollment. While recent labor market strength has helped to counteract this trend, public policies could also be put in place that reinforce the value to young people of gaining early work experience. One such policy is a recent proposal from the Trump administration to direct federal education funding to “earn while you learn” programs and short-term training programs at trade schools and community colleges. The administration has also proposed extending funding for the federal work study program to community colleges and trade schools, rather than just to four-year universities.31

Older

Also evidenced in the previous section, the LFPR for older workers increased during and shortly following the Great Recession, but has stagnated in the years since. One potential policy remedy would be to remove the “earnings test” for individuals who take their social security benefits before full retirement age. The earnings test reduces the social security benefits for older people who continue working, have not reached full retirement age, and earn more than roughly $17,000 per year.32 Thus, removing the earnings test would remove a major disincentive to work for those who elect to take social security benefits before full retirement age.

Felons

A recent study estimated that there were 19.6 million people in the United States with felony records as of 2010,33 representing nearly 13% of the civilian labor force that year. It is widely known that felony records represent a serious impediment to finding work. Research has concluded that as of 2008, 1.5 to 1.7 million people were not employed as a result of felony records.34 This is equivalent to 1.0%-1.1% of the average 2008 civilian labor force, based on BLS data. Public policies may be able to improve labor market outcomes for people with felony records by increasing funding for felon training and reintegration programs. The government could also consider offering temporary tax deductions to employers that elect to hire former felons.

ECONOMIC & INVESTMENT IMPLICATIONS

Based on the estimates above, a cyclical labor force rebound and targeted public policies could potentially bring millions of new workers into the U.S. labor force. But if the cyclical rebound is maintained or certain of these public policies are implemented, how would it affect potential GDP growth? The implications may be significant: the White House has targeted 3% GDP growth in the coming years, and if potential GDP can also achieve 3% growth, it will signify that higher economic growth can be sustained over the longer term.

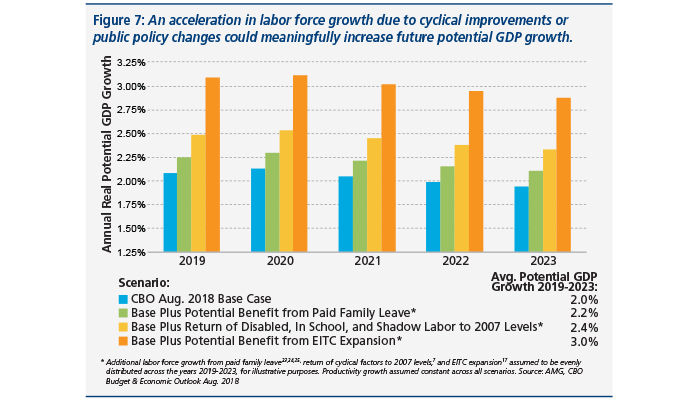

Over the next five years, from 2019 through 2023, the CBO’s August 2018 base case forecast projects that U.S. potential GDP will grow by an average of 2% per year. Built into this base case are assumptions that the cyclical gap in labor force participation is already largely eliminated by 2018, that the number of people on disability will continue to trend upward, and that school enrollment will remain flat despite recent declines.(35) As a result, it may be reasonable to add to the CBO’s baseline some labor force growth improvements from lower disability claims and school enrollment, as well as potential benefits from proposed public policies.

Figure 7 compares the CBO’s base case projections for potential GDP growth from 2019 through 2023 to several hypothetical alternate scenarios: (1) base case growth plus the return of disability claims, in school, and shadow labor to 2007 levels; (2) base case growth plus the potential benefit of federally mandating paid family leave; and (3) base case growth plus the potential benefit of expanding the EITC for childless adults. Each scenario assumes that all labor force benefits are evenly distributed across the five-year period from 2019 through 2023 and that no additional labor force benefits overlap with the CBO base case. Therefore, the potential GDP benefit from additional labor force growth in each scenario is simply added to CBO’s base case potential GDP growth rate each year.

As the comparison illustrates, additional labor force benefits from the cyclical labor market rebound and certain public policies could have a meaningful positive impact on U.S. potential GDP growth. This matters for the health of the economy because, as previously mentioned, the Fed closely monitors the gap between actual GDP and potential GDP in determining how quickly to raise interest rates.

If it is true that recent CBO forecasts for potential GDP are artificially low due to lingering impacts from the Great Recession, the Fed may think the economy is closer to overheating than it actually is and might raise interest rates too quickly. Higher interest rates can reduce U.S. economic growth and could also pull forward the timing of the next economic recession. On the other hand, if potential GDP growth accelerates on the back of stronger labor force growth, the Fed may feel the economy has more room to expand before it overheats. In this situation, the Fed might raise interest rates more slowly, which would give the U.S. economy more time to grow and could lengthen the current economic expansion.

All else equal, lower interest rates and a longer economic expansion should bode well for investors. As market participants lower their expectations for future interest rate increases, bond investors could get a temporary reprieve from the pain of rising interest rates. Stock investors might also benefit, as lower interest rates help support higher equity valuations. Further, any lengthening of the current economic expansion could benefit all investors by continuing to support healthy economic activity and corporate profit growth.

AMG’s research suggests that potential labor force growth depends on more than just demographics, and that future labor force growth is not a foregone conclusion. Rather, strength in the U.S. labor market and support from public policy could have a meaningful positive impact on both potential labor force growth and potential GDP growth going forward. Any resulting increase in U.S. potential output from currently depressed levels could also lead to more accommodative monetary policy from the Fed and an extension of the U.S. economic expansion.

Notes

- CBO Budget & Economic Outlooks Aug. 2007 and Aug. 2018.

- Shackleton, Robert. Estimating and Projecting Potential Output Using CBO’s Forecasting Growth Model. Congressional Budget Office, Feb. 2018, www.cbo.gov/system/files/115th-congress-2017-2018/workingpaper/53558-cbosforecastinggrowthmodel-workingpaper.pdf.

- Coibion, Olivier, et al. Real-Time Estimates of Potential GDP: Should the Fed Really Be Hitting the Brakes? Center on Budget and Policy Priorities, 31 Jan. 2018, www.cbpp.org/research/full-employment/real-time-estimates-of-potential-gdp-should-the-fed-really-be-hitting-the.

- Based on the average of monthly year-over-year percent growth during the expansion periods in question (Nov. 2001 – Dec. 2007 and Jul. 2009 – Jul. 2018). Source: BLS.

- Calculated using Atlanta Fed estimates (see note 7). (2017 civilian population * 2007 LFPR) – (2017 civilian population * 2017 LFPR).

- Shadow labor as defined by the Atlanta Fed refers to anyone who wants a job but is not looking for one, generally due to discouragement or related marginal attachment to the labor force.

- Labor Force Participation Dynamics. Federal Reserve Bank of Atlanta, 22 Feb. 2018, www.frbatlanta.org/chcs/labor-force-participation-dynamics.aspx.

- Long-term unemployment refers to those unemployed (and actively seeking work) for 27 weeks or more. Source: The Labor Force Participation Rate Since 2007: Causes & Policy Implications. Obama White House, July 2014, obamawhitehouse.archives.gov/sites/default/files/docs/labor_force_participation_report.pdf.

- Based on seasonally-adjusted monthly data as reported by BLS.

- Legal Immigration to the United States, 1820-Present. Migration Policy Institute, 9 Aug. 2018, www.migrationpolicy.org/programs/data-hub/charts/Annual-Number-of-US-Legal-Permanent-Residents.

- Calculation based on estimate of immigrant population and employed immigrants in 2014. Source: López, Gustavo, and Kristen Bialik. Key Findings about U.S. Immigrants. Pew Research Center, 3 May 2017, www.pewresearch.org/fact-tank/2017/05/03/key-findings-about-u-s-immigrants/.

- Calculation based on estimate of immigrant population and employed immigrants in 2014. Source: Camarota, Steven, and Karen Zeigler. Immigrants in the United States. Center for Immigration Studies, 3 Oct. 2016, cis.org/Report/Immigrants-United-States.

- Relative to Jul. 2018 civilian labor force size as reported by BLS.

- Schanzenbach, Diane, et al. Who Is Poor in the United States? The Hamilton Project, 17 June 2016, www.hamiltonproject.org/papers/who_is_poor_in_the_united_states.

- Annual average participation rate of 62.9% for the year 2014 as reported by BLS.

- For childless workers age 21-66. Source: Marr, Chuck, et al. Strengthening the EITC for Childless Workers Would Promote Work and Reduce Poverty. Center on Budget and Policy Priorities, 11 Oct. 2017, www.cbpp.org/research/federal-tax/strengthening-the-eitc-for-childless-workers-would-promote-work-and-reduce.

- Holtz-Eakin, Douglas, et al. The Work and Safety Net Effects of Expanding the Childless EITC. American Action Forum, 2 Feb. 2016, www.americanactionforum.org/research/the-work-and-safety-net-effects-of-expanding-the-childless-eitc/.

- Based on annual average labor force participation by gender as reported by BLS.

- “Employment: Labour Force Participation Rate, by Sex and Age Group.” OECD Statistics, Organization for Economic Cooperation and Development, stats.oecd.org/index.aspx?queryid=54741.

- Shambaugh, Jay, et al. Lessons from the Rise of Women’s Labor Force Participation in Japan. The Hamilton Project, 1 Nov. 2017, www.hamiltonproject.org/papers/lessons_from_the_rise_of_womens_labor_force_participation_in_japan.

- DeSilver, Drew. Access to Paid Family Leave Varies Widely Across Employers, Industries. Pew Research Center, 23 Mar. 2017, www.pewresearch.org/fact-tank/2017/03/23/access-to-paid-family-leave-varies-widely-across-employers-industries/.

- Cost of parental benefits 2019-2023 from Office of Management and Budget’s Fiscal Year 2018 Budget.

- Goldin, Claudia, and Joshua Mitchell. “The New Life Cycle of Women’s Employment: Disappearing Humps, Sagging Middles, Expanding Tops.” Journal of Economic Perspectives, vol. 31, no. 1, 2017, pp. 161–182., pubs.aeaweb.org/doi/pdf/10.1257/jep.31.1.161.

- AMG estimate based on improvement in LFPR from Goldin (see note 24) and assuming number of births of prime-age women in 2017 continues 2019-2023. Source: Tanzi, Alexandre. Number of U.S. Births Fell to a 30-Year Low Last Year. Bloomberg, 16 May 2018, www.bloomberg.com/news/articles/2018-05-17/number-of-u-s-births-fell-to-a-30-year-low-last-year.

- Kearney, Melissa S., and Lesley J. Turner. Giving Secondary Earners a Tax Break: A Proposal to Help Low- and Middle-Income Families. The Hamilton Project, July 2013, www.hamiltonproject.org/assets/legacy/files/downloads_and_links/THP_Kearney_DiscPaper_Final.pdf.

- Duggan, Mark G. Testimony before the United States Senate Committee on the Budget. Stanford University, 11 Feb. 2015, www.budget.senate.gov/imo/media/doc/senatebudget-mgd-feb11final.pdf.

- Krueger, Alan B. Where Have All the Workers Gone? An Inquiry into the Decline of the U.S. Labor Force Participation Rate. Brookings Papers on Economic Activity, 8 Sept. 2017, www.brookings.edu/wp-content/uploads/2017/09/1_krueger.pdf.

- Calculated as one-fifth of decline in prime-age male LFPR 1999-2015 * 2015 civilian labor force. Source: BLS.

- Carnevale, Anthony, and Nicole Smith. Trillion Dollar Infrastructure Proposals Could Create Millions of Jobs. Georgetown University Center on Education and the Workforce, 2017, cew.georgetown.edu/wp-content/uploads/trillion-dollar-infrastructure.pdf.

- Daly, Mary, and Tali Regev. Labor Force Participation and the Prospects for U.S. Growth. Federal Reserve Bank of San Francisco, 2 Nov. 2007, www.frbsf.org/economic-research/publications/economic-letter/2007/november/labor-force-participation-us-growth/.

- Acosta, R. Alexander. Trump Infrastructure Plan Provides Skilled Jobs. The White House, 4 Apr. 2018, www.whitehouse.gov/articles/trump-infrastructure-plan-provides-skilled-jobs/.

- Based on 2018 exemption amount. Source: Exempt Amounts Under the Earnings Test. Social Security Administration, www.ssa.gov/oact/cola/rtea.html.

- Shannon, Sarah K.S. The Growth, Scope, and Spatial Distribution of People with Felony Records in the United States, 1948 to 2010. Demography, July 2016, users.soc.umn.edu/~uggen/former_felons_2016.pdf.

- Schmitt, John, and Kris Warner. Ex-Offenders and the Labor Market. Center for Economic and Policy Research, Nov. 2010, cepr.net/documents/publications/ex-offenders-2010-11.pdf.

- Montes, Joshua. CBO’s Projection of Labor Force Participation Rates. Congressional Budget Office, Mar. 2018, www.cbo.gov/system/files?file=115th-congress-2017-2018/workingpaper/53616-wp-laborforceparticipation.pdf.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.