The Gray Divorce Revolution: How to Keep Your Golden Years Golden

• 9 min read

Get the Latest Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

Key takeaways

- Engage Expert Financial and Legal Counsel. High net-worth divorces are typically quite complex, but when you factor in having been married for a long time and nearing retirement or having already retired, it’s crucial to have a team in place to help protect your interests and long-term financial security.

- The Full Extent of Your Financial Picture. Older adults negotiating a late-in-life divorce settlement tend to have more assets and financial obligations that are intertwined. It’s important to not only understand what you own, but also what you owe.

- Retirement Savings and Tax Implications. Divorcing close to retirement can severely impact your plans, and decisions on how to split and transfer retirement accounts can have personal tax consequences.

- Revise Your Estate Plan. Wills, trusts, powers of attorney, and beneficiary designations likely need to be updated to reflect your new circumstances.

Since 1990, the phenomenon known as “gray divorce”—a term used to define late life divorces of individuals over the age of 50—has been on the rise.

According to an analysis of divorce data released in July 2023 by Bowling Green State University’s National Center for Family and Marriage Research, the most significant increase in divorce rates occurred with people 65 and older, which tripled from 1990 to 2021.

Longer life expectancy, becoming empty nesters, and a reduced stigma associated with baby boomer divorces are each partly behind the rising gray divorce rate. Regardless of the reasons, a gray divorce among affluent older couples comes with its own set of financial challenges that differ from a middle-age high-net-worth divorce.

Gray divorce issues include untangling potentially complex finances, property division (including the marital home), the disruption to retirement plans, less earning potential, spousal maintenance, estate planning and beneficiary designations.

Gray divorce can be especially difficult for women: They are more likely than men to emerge from gray divorces in an economically disadvantaged position.

Engage Expert Financial and Legal Counsel

Assembling a team of experts is essential to safeguard assets and lay the groundwork for a secure post-divorce future. Consider including:

- Divorce Attorneys Specializing in High Net-Worth Individuals. Your divorce attorney should be adept at negotiating and litigating issues such as complex marital property division.

- Financial Advisor. Your attorney can help you achieve what you deserve, but a financial advisor can evaluate and explain the long-term impact of settlement options along with restructuring your financial plan to avoid post-divorce financial challenges.

- Tax Advisor. Your accountant can help you optimize for tax impact when deciding on the equitable split of marital property.

- Estate Planning Attorney. Your estate planning attorney can help with updating documents such as will, trusts, powers of attorney, and medical directives to protect your legacy and make sure your assets are distributed to the individuals and organizations you wish.

The Full Extent of Your Financial Picture

Splitting marital property

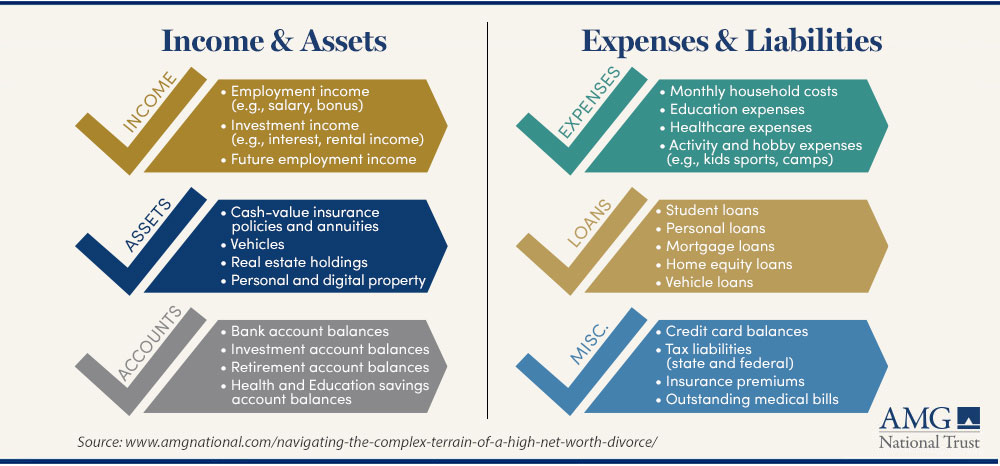

Individuals exiting long-term marriages may not have the benefit of a prenuptial agreement but likely have finances, assets, and debt that are deeply entwined, necessitating a clear understanding of whether assets are marital property or separate.

DOWNLOAD: “Checklist of Financial Disclosure Items” details the documents and records that likely will have to be disclosed in divorce proceedings.

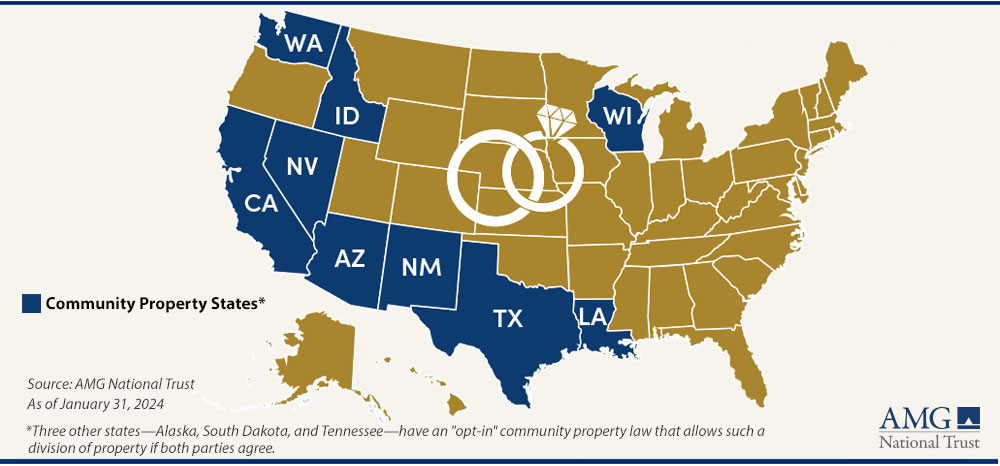

The approach to asset division depends on whether the state where you reside is an equitable distribution state or a community property state.

In equitable distribution, the court will aim to divide assets in a manner deemed to be “fair,” which doesn’t necessarily mean equally. This approach generally involves looking at things like the financial needs of each individual, contributions to the marriage, duration of the marriage, age and health of both spouses, and employability and earning power.

Conversely, a community property state will look to divide assets 50/50. Also, it’s possible that a divorcing couple can come to their own agreement on the division of assets.

Dividing debt acquired during marriage

Like assets, it’s important to determine whether debts are marital or separate.

Considering the type of asset and available income stream to service the debt will be important in negotiating the division of debt as well as identifying which debts are or should be considered jointly owned and the responsibility of each spouse. It’s important to know that legal responsibility for the debt does not always align with the person whose name may be on the account.

Dividing debt requires careful analysis, strategic negotiation, and a clear understanding of legal and financial implications. Engaging with divorce lawyers and financial advisors to guide you through this process can help see that debts are divided fairly and that your financial health is protected post-divorce.

Case Study – Dividing a Three-Decade Marriage

After 30-plus years of marriage, Sandy and Gary decided to divorce. They had accumulated significant assets, including a primary residence, a vacation home, investment portfolios, and a jointly owned business. Alongside their assets, they’ve also accrued various debts, including a mortgage on the vacation home, a line of credit for the business, and multiple credit cards.

Sandy and Gary strategized with an equitable distribution approach, including considering the relevant tax implications.

The first step was to identify and value the couple’s debts:

- Mortgage on Vacation Home: $1.5 million

- Business Line of Credit: $400,000

- Credit Card Debt: $40,000

After discussions with their advisors, they sold the vacation home and used the proceeds to pay off the mortgage. The remaining proceeds were then divided proportionally based on their contributions to the purchase and maintenance of the home over the years.

Because Gary had deeper involvement and interest in continuing with the business post-divorce, he agreed to take full responsibility for the business, including its future cashflows and its line of credit. In exchange, Sandy received a larger portion of the investment portfolio.

They also agreed to divide the credit card debt equally. Both parties decided to pay off their respective shares immediately.

Their final divorce settlement included specific clauses to protect each party if the other failed to meet their debt obligations as agreed, particularly concerning the business line of credit.

Retirement Savings and Tax Implications

Retirement accounts are often assets that represent a significant portion of wealth for baby boomers. Therefore, it’s important to have an advisor who can help you evaluate these assets through the lens of current and future value, as well as pre- and post-tax value. A few retirement account considerations include:

- IRAs (Traditional and Roth) – Treating your share of these accounts as a transfer incident or rollover from the IRA can avoid tax consequence.

- 401(k)s and 403(b)s, or related plan – If you are not yet age 59½, a qualified domestic relations order (QDRO) issued by a divorce court can help limit tax consequences when the assets are transferred directly to a spouse’s IRA.

- Pension Plans – Spouses are often eligible for half the amount accumulated in a plan during marriage. Your advisor likely will weigh the impact and tax consequences of seeking part of the benefits versus swapping it for another asset.

- Investment accounts – Includes stocks, bonds, and mutual funds that may have been earmarked for retirement, but these do not have the same tax advantages as retirement accounts, thus the holdings in these accounts are generally taxable if sold for a gain.

- Stock Options and Restricted Stock Units (RSUs) – The worth of these assets can depend on future stock performance and vesting schedules, and can be particularly complex to value and divide.

- Social Security Benefits – You may be eligible for social security benefits based on your former spouse’s earnings records, depending on factors such as your length of marriage, and whether your former spouse is receiving benefits, among other things.

Tax Consequences of Divorce

Understanding the tax implications of selling, transferring, or splitting assets often has personal tax consequences particularly with higher amounts of wealth. Strategic planning with a tax advisor and a financial advisor can help identify opportunities for tax savings and avoid potential pitfalls. A few key areas to watch for include:

- Capital Gains Tax – When dividing assets, especially high-value assets such as real estate or investment portfolios, you will want to be mindful of the cost basis and current value of these assets. In some cases, it may be beneficial to transfer certain assets while still married to take advantage of IRS gift-splitting rules, or to sell a high-value asset to utilize the higher capital gains exclusion available to married couples who file jointly.

- State Taxes and Residency – State income taxes, estate taxes, and property taxes should also be considered when dividing assets. While up to $13.61 million per individual in 2024 is exempt from federal taxes upon your death, 12 states and the District of Columbia also impose some form of estate taxes. Six states impose an inheritance tax.

Revise Your Estate Plan After a Gray Divorce

Your estate plan and beneficiaries should reflect your new life path.

- Will – A will dictates how assets are distributed upon your passing. Do you wish to keep your former spouse as a beneficiary?

- Trusts – You may need to change beneficiaries or terms of the trust after the divorce.

- Durable Power of Attorney – This document can give someone the authority to make decisions on your behalf should you become incapacitated, including making financial and or medical decisions.

- Beneficiary Designations on Retirement Accounts and Insurance Policies – Retirement and investment accounts with transfer on death beneficiaries designated, as well as life insurance policies, typically do not go through probate, but pass directly to the named beneficiary on the account. If you are married and there hasn’t been a waiver, your spouse is automatically the beneficiary of your ERISA-qualified retirement asset. A divorce decree that states you may remove your ex-spouse as a beneficiary could be discounted in court if you haven’t filed the removal paperwork.

- Digital Assets – These assets include social media accounts and online banking accounts. Consider who you want to have access to these accounts going forward, and who will inherit any wealth associated with the account.

DOWNLOAD REPORT

Frequently Asked Questions

A gray divorce is a term generally used to describe divorcing couples over the age of 50.

Older couples can help protect their financial well-being when navigating a gray divorce by:

- Engaging expert financial and legal counsel,

- Understanding the full extent of their financial picture,

- Understanding the short- and long-term impact on retirement savings as well as the tax implications on the division and acquisition of some assets.

A study by Bowling Green State University found that women over the age of 63 were roughlytwice as likely to face financial difficulties than men after divorce, highlighting the need to protect their financial interests.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.