Navigating the Complex Terrain of a High-Net-Worth Divorce

• 11 min read

Get the latest in Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

Key Takeaways

- Build a Strong Advisor Team: Engaging an experienced financial advisor and an attorney who specializes in divorce is crucial when dealing with substantial assets and financial complexities.

- Gather and Assess Financial Information: Conduct a comprehensive assessment of all marital assets, including real estate, investments, businesses, and personal belongings, to ensure an accurate valuation for future distributions.

- Protect Your Financial Future: A prolonged settlement process can take away from the final settlement. Consider the essential items for your post-divorce life.

- Analyze Possible Divorce Settlement Options: Be mindful of the tax consequences of asset division and distribution, and spousal support agreements. Optimize your taxes during and after the divorce.

- Update Your Estate Plan: Align estate items with your post-divorce circumstances, including updating titles, beneficiaries, and trustees, as needed.

Divorce is a life-altering event that demands careful financial planning and execution, particularly for high-net-worth individuals. With the right guidance and a well-thought-out financial strategy, you can position yourself to turn the page with better financial security and peace of mind.

Download our free 12-page page report “Visualizing a Financial Path through Divorce” for additional details on key steps of the divorce financial planning process.

Build a Strong Advisor Team

Divorce proceedings may leave you feeling alone and uncertain. It requires making potentially life-altering decisions in an environment where often you don’t know what you don’t know.

While family and friends may provide emotional support during a difficult time, it is also important to closely engage with experienced advisors who focus on your interests with specialized expertise to help you through each stage of the process, including:

- Financial planner

- Tax advisor

- Divorce/family law attorney

- Trust and estate attorney

Because divorce can significantly change financial circumstances, to create a fair settlement you need to carefully consider the implications of the division of assets and liabilities, alimony and child support payments, and other financial issues.

Consider that a divorce attorney may be able to help you navigate the legal process of divorce. A trust and estate attorney can help adjust wills, trusts and other documents related to the new circumstances of your estate. A tax advisor can discuss tax implications of various decisions and prepare tax returns.

While each expert is important, a comprehensive wealth manager like AMG can integrate financial planning, tax strategy, and trust and estate planning, which may be the most efficient and effective way for you to protect future wealth opportunities.

Gather and Assess Financial Information

A complete disclosure of all assets and liabilities generally is required to determine what is marital versus separate property.

Income & Assets

Expenses & Liabilities

Gather key financial documents, such as a net worth statement or recent pay stubs, bank statements, tax returns, brokerage and retirement account statements, Social Security benefit statements, property purchase records and titles, appraisals, insurance documents, and private business records. Be sure to include relevant details.

For a primary residence, for example, include things like the date acquired, initial versus current valuation, improvements made, maintenance costs, and estimates for any deferred maintenance such as a new roof or HVAC system.

You should also have all documents related to your children, any estate and financial planning documents such as wills, trusts, medical directives, and powers of attorney, and any prenuptial or postnuptial agreements.

If one spouse suspects there may be hidden assets the other spouse is not being forthright in disclosing, a forensic accountant may be worth engaging.

Protect Your Financial Future

What will it take to secure your future? You will need a clear-eyed assessment of your needs versus wants, and your non-negotiables versus nice-to-haves.

You may not feel willing to compromise, but a protracted settlement battle will cost you added time and money. That cost also may reduce the final settlement.

That settlement should consider certain financial needs:

- Anticipated post-divorce income—including spousal and child support—and expenses. Be realistic about being able to maintain a higher standard of living than new financial circumstances permit.

- Health insurance. Will you maintain a policy on your own, or is it part of spousal support?

- The family home. A jointly titled primary residence and its mortgage can pose a division problem. To remove a spouse from the mortgage and title, the property may need to be refinanced—which can be costly.

- Life insurance. If there are children, both parents may wish to have a policy. Also, a policy can be required to safeguard alimony or child support payments.

- Retirement investments. Dividing assets can throw portfolios out of balance and alter your tax strategies. Your priorities also may have shifted, for instance, to paying off bills or saving for a new home.

- Credit monitoring. A divorce itself does not necessarily impact your credit, but poor management of available credit can.

RELATED ARTICLE: “Can You Have Good Income but Bad Credit” explains how to maintain a high credit score.

Analyze Possible Divorce Settlement Options

The equitable distribution of marital property does not necessarily mean a simple 50-50 division of each asset between spouses.

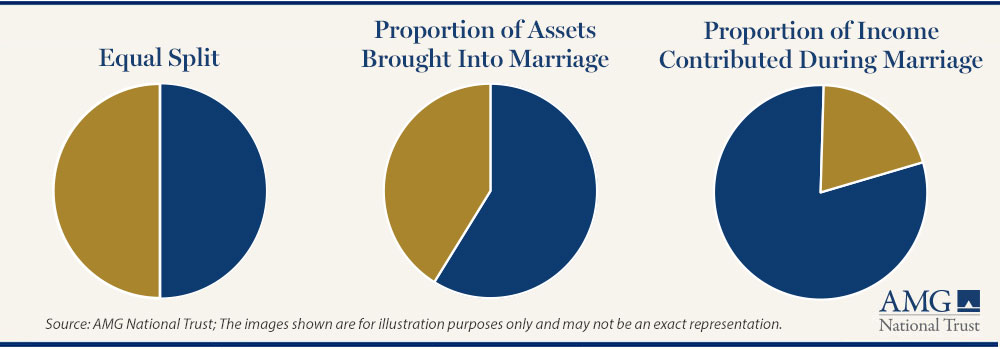

It could involve a discussion of the fair market value of total marital property, what the equitable division of it might be, and then allocating specific assets. A fair division of assets and liabilities could be 50-50, a proportion of what each side brought into the marriage, or perhaps a split based on the annual income contributed to the marital household.

50-50 split not always wise

Did you come into marriage with equal assets or did one partner bring significantly higher wealth or debts? If you put a promising career on hold to raise children or to accommodate your spouse’s employment, you likely don’t want to be left with less than what you started with.

Your advisors will likely want to dig deeper into key financial records and consider what type of assets are being talked about, such as property, retirement savings, stock options and other executive compensation benefits—and any taxes tied to those assets.

When working to settle the division of assets in your marriage, it can be helpful to forecast your future income and spending needs as independent households. These expectations also can inform petitions for alimony and child support.

Other important considerations include:

- Is there something that you brought into the marriage that you want to retain?

- Is there a marital asset to which you contributed more toward?

- Are some assets riskier than others?

- What are your liquidity and cash flow needs? Agreeing to accept future benefits such as Social Security, pension or other retirement accounts won’t put money in your pocket today.

Although a prolonged divorce can be costly, be careful in making quick decisions to speed up the divorce process. The desire to move things along quickly is understandable, but the risk to your financial future is that you are giving away something you shouldn’t or are accepting something without fully understanding the implications.

Tax implications buried in each decision

Selling, transferring, or splitting an asset often has important personal tax implications, particularly when they involve higher amounts of wealth or complicated compensation structures.

Because taxes can erode the value of the assets a party receives, it is crucial to understand whether the value that appears reasonable at first glance is the pre-tax or after-tax value. For example, $100,000 in a traditional retirement account is not the same as $100,000 in a Roth retirement account because the former is taxable at withdrawal and the latter is not.

Likewise, consider whether to accept homes or other properties based on their current value and the potential capital gain or loss if you were to sell, or how to handle investments in a brokerage account considering potential tax consequences for gains above the cost basis.

Your financial advisor can examine each asset and liability and present you with options to optimize your tax efficiency during and after the divorce.

State laws governing divorce proceedings

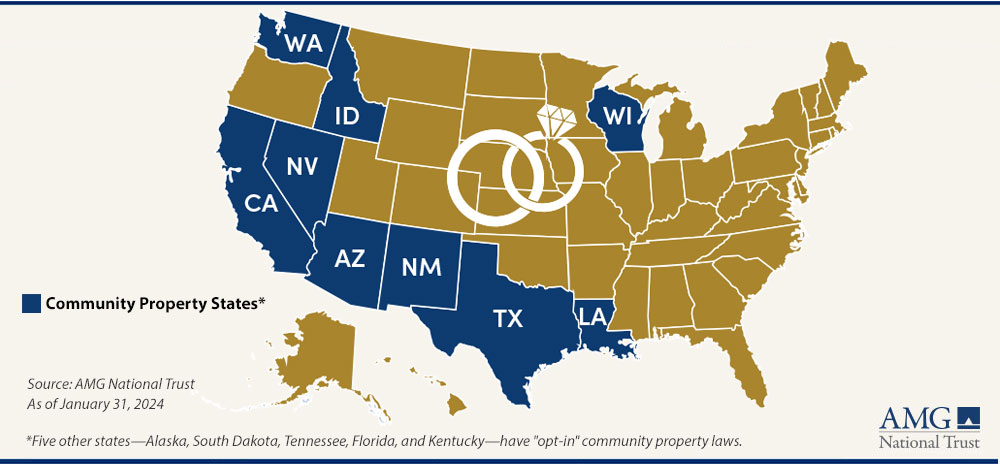

When spouses are unable to agree on a divorce settlement, the laws in each state generally kick in. If you live in one of the nine community property states, an asset or liability may be considered the equal property of both parties if acquired during marriage, with some exceptions.

The majority of states are common law property states where an asset or liability is generally the property of the person to whom it is titled regardless of when it was acquired. These states distribute marital property based on an agreement of the parties or in a manner that the court deems “fair” to both parties, but not necessarily equal. This is called “equitable distribution.”

However, some assets already may have been shielded from a divorce settlement.

- Trust. A high-net-worth family may choose to protect its financial interests through a trust. Depending on the type and trust terms, assets held in a trust may remain separate from marital property so long as they were not commingled during marriage. Your advisors likely would want to trace the source of assets into the trust to help accurately determine which assets could be considered marital property.

- Prenup. A prenuptial agreement also can remove specific assets from marital property, specify the amount and length of alimony to be paid in the event of divorce, and discuss custody and child support issues. Certain conditions must be met for a prenup to be considered valid during the divorce process.

Update Your Estate Plan

Do you want your former spouse to remain as the primary beneficiary on your retirement accounts, investment accounts, bank accounts, insurance policies, pension, or any other element of your estate plan?

Divorce generally does not force any automatic changes to beneficiary designations, nor does it prevent you from keeping a former spouse as a beneficiary. The choice is yours, though your decision should reflect your new life rather than the past.

After the divorce decree, you, and potentially your advisors, should retain a copy of the settlement to be aware of any obligations you continue to have to your former partner.

Also consider reviewing these items:

- A will, because divorce can alter or void some provisions

- A trust, particularly if it held marital property that was included in the settlement

- Healthcare power of attorney

- Guardianship of minor children

- If you are planning to remarry, consider a prenup to safeguard assets for children from a previous relationship or to clarify payments to a previous partner.

PARTNER WITH AMG AND START BUILDING YOUR FUTURE

Divorce negotiations can seem never-ending, but having a trusted financial advisor and comprehensive wealth manager by your side can help. Our role as part of your team is to help make it more manageable by identifying key financial decisions and potential risks, while also modeling various scenarios to help explain the financial trade-offs of each decision.

If you are almost through the divorce process, ensure your advisor can facilitate your next steps—a partner that understands your financial goals and evolves as you do. AMG’s comprehensive solutions seamlessly connect every aspect of our firm—wealth management, taxes, philanthropy, retirement planning, and more—to deliver toward your success.

If you would like to schedule a free consultation with AMG about financial security after divorce, call 800-999-2190 or email with the best day and time to reach you.

REQUEST REPORT

Frequently Asked Questions

One of the first steps in navigating divorce should be assembling a team of experienced advisors focused on your interests and needs, including:

- Financial advisor

- Tax advisor

- Divorce attorney

- Trust & estate attorney

There are several essential considerations to achieve a successful high-net-worth divorce settlement:

- Start with a detailed list of all the marital assets and liabilities

- Determine whether you wish to stay in the home or sell and start fresh

- Discuss arrangements for child custody, child support, and co-parenting

- Identify current incomes and needs for spousal support

- High-net-worth individuals should not overlook investments such as stocks, retirement accounts, trusts, family businesses, and collectibles

- Adjust insurance policies and beneficiaries for your new life

Parents may wish to come to their own agreement on custody; otherwise, the court will decide for you. In addition, each state has its own formula for calculating the total child support obligation. Factors affecting the calculation include each parent’s income, the number of children, whether there is a primary custodial parent, and the children’s time spent with each parent. Pets can also be part of a custody agreement.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.