Unemployment Disparity Casts Shadow on Recovery

• 2 min read

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.

The COVID-19 recession is playing out as a tale of two economies.

On one hand, there is the plight of low-income wage earners. Toward the end of the decade-long U.S. economic expansion, these workers started finding some financial stability. Unemployment had hit record lows, and wages had begun climbing modestly for men and women of all races. The pandemic ended all that.

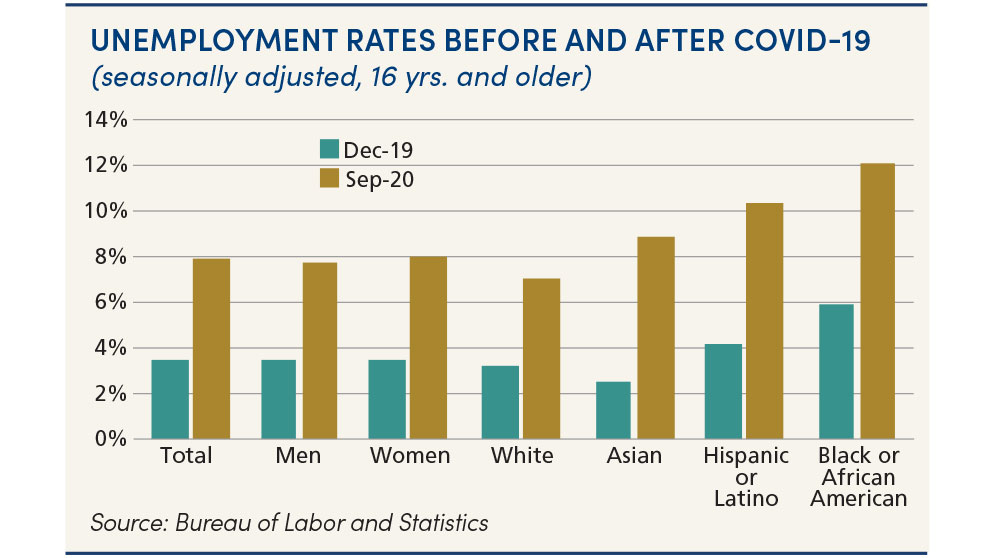

Since April, nonwhite lower-wage workers, particularly women, have been disproportionately impacted by the pandemic-induced recession. While the overall unemployment rate registered 7.9% last month, for black workers it stood at 12.1% and for Hispanics it hit 10.3%. Women of all races have endured a higher unemployment rate than men and are leaving the workforce at a concerning rate.

On the other hand, highly educated and well-off workers have already made a rapid rebound and are largely prospering during the COVID-19 recession. Household wealth, home value and the stock market are back near record highs.

This dichotomy is striking and could hinder the economy’s long-term recovery because job gains by the working class are essential to sustainable growth. Fortunately, the Federal Reserve is addressing the problem.

In August, the Fed issued new monetary-policy guidance that emphasizes employment concerns over possible inflation growth. Essentially, this is code indicating the Fed is willing to tolerate an inflation rate above 2% in order to support the economic recovery and restore employment to pre-pandemic 2019 levels.

So why is the Fed willing to relax its role in managing inflation? Because that’s no longer the biggest problem the U.S. economy faces. The monster these days is a pandemic that has wiped out all the benefits of a strong labor force and is disproportionately affecting the lowest wage earners. The Fed is taking a chance that allowing higher inflation during the recovery will result in more lower-wage earners being brought back into the economy with jobs that can be sustained. Can the Fed do this without accelerating inflation too much and being forced to slow the economy which would impact the very people it is trying to help? This is new territory for the Fed, and only time will tell if its plan works.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.