Deciding Between a Traditional or a Roth 401(k)?

• 6 min read

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.

The shift from defined benefit (traditional pension) plans to defined contribution plans has placed the burden of building a nest egg for retirement squarely on employees.

To make the most of your employer-sponsored defined contribution or 401(k) plan, you will face several key decisions, including which account type to fund: a traditional 401(k) or a Roth 401(k).

PRE-TAX VS. AFTER-TAX CONTRIBUTIONS

With a traditional 401(k), you make pre-tax contributions to a tax-deferred retirement savings account. Because contributions are made “above the line,” they lower your taxable income and required tax withholdings for the tax year. As a result, the overall impact on your paycheck may be less than you think.

For example, if you earn $200,000 per year, your federal tax rate is 32% and you contribute 7% (about $538) of your salary pre-tax to a traditional 401(k) account biweekly, you will reduce your net pay by only about $366. The $538 goes into your retirement account and is immediately invested, but the favorable tax treatment means that it effectively only costs you $366 in the current year.

You can defer taxes with a traditional 401(k), but not avoid them. In exchange for the current tax-year discount, you must pay taxes on future distributions from the account, including earnings.

Roth 401(k) contributions are the opposite, from a tax perspective. Contributions to a Roth 401(k) account are “below the line,” after taxes are deducted from your pay. You do not get the $172 current tax-year discount. But in contrast to a traditional 401(k), all future qualified distributions are tax free.

IS A ROTH 401(K) OR A TRADITIONAL 401(K) BETTER?

To decide whether a Roth 401(k) or a traditional 401(k) account is better for you, you will need to think about how your tax rate today compares with your expected tax rate in the future. If you think your income and tax rate will increase in retirement, a Roth 401(k) may make sense. If the reverse is true, you may benefit more from a traditional 401(k).

In making this analysis, keep in mind that many retirees are surprised that their marginal tax rate does not go down much in retirement—if at all. These are some of the factors that may keep you in a higher tax bracket:

-

- A younger, still-working spouse.

- Investments in rental properties or other income sources.

- Continuing to work part-time, serve on boards, or start a business.

- Highly appreciated traditional 401(k) accounts with required minimum distributions (RMDs).

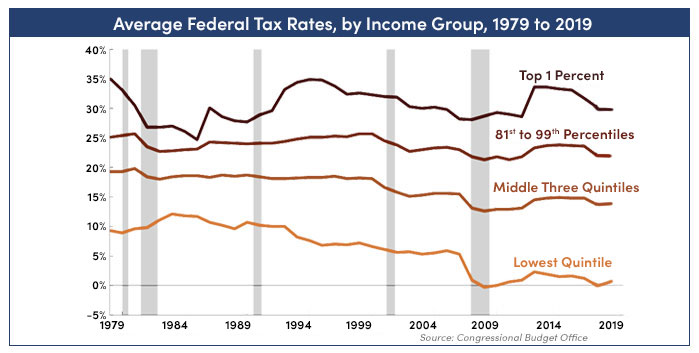

Also, according to the Congressional Budget Office, average federal tax rates were at their lowest in decades, as of 2019. If they move in any direction in the future, it’s likely to be up.

Additional considerations may include:

-

- How long do you have before you need to make a withdrawal?

As Roth 401(k) contributions are made after-tax, there are fewer penalties if an emergency arises. Similar to a traditional 401(k), you may pay a 10% early withdrawal penalty and taxes on the earnings in the account, but you will not pay taxes on the contributions you had made. - How much financial flexibility do you have currently?

Since a pre-tax contribution today will decrease your current-year taxes, you likely will be able to spend or save more. Do you have current-year obligations that you must meet and therefore need a higher paycheck? - How much financial flexibility do you want in the future?

Traditional 401(k) accounts require minimum distributions (RMDs) starting at age 73. So do Roth 401(k) accounts, but that changes in 2024. That is when RMDs no longer will be required from designated Roth 401(k) accounts. Having a mix of traditional and Roth 401(k) accounts can allow you to manage RMDs, and better time the income you want versus the income you must take in any calendar year. Additionally, beneficiaries of a Roth 401(k) or a Roth IRA are not subject to RMDs or taxes on withdrawals. - Does your employer match contributions to a traditional 401(k) differently versus a Roth 401(k)?

Matching contributions are not mandatory. Typically, if an employer matches contributions, they will seek to make it the same for traditional and 401(k) accounts.

- How long do you have before you need to make a withdrawal?

SUMMARY OF KEY FEATURES OF TRADITIONAL AND ROTH 401(K)S

Traditional 401(k)

-

- Contributions are made pre-tax, i.e., they reduce taxable income.

- Paychecks are higher due to lower withholding.

- Taxes on contributions and growth are deferred until distributed.

- Required minimum distributions (RMDs) start at 73.

- Beneficiaries are subject to RMDs and taxes on withdrawals.

Roth 401(k)

-

- Contributions are made after-tax, i.e., they do not reduce taxable income.

- Paychecks are lower due to full withholding.

- Tax-free distributions may start penalty free at age 59½ and if the account has been open for at least five years.

- Beginning in 2024, there are no required minimum distributions (RMDs).

- Beneficiaries to a Roth 401(k) or a Roth IRA are not subject to RMDs or taxes on withdrawals.

CONSIDER DIVERSIFYING 401(K) ACCOUNTS FOR FUTURE FLEXIBILITY

Just as you would diversify your investments, do not overlook the potential benefits of managing your future income and marginal tax rate by building both traditional and Roth 401(k) savings.

By splitting your contributions between traditional and Roth 401(k) accounts, you may be able to have the best of both worlds: some current-year tax benefit and some future flexibility in managing withdrawals for the maximum tax benefit.

For example, in high-income retired years when your tax rate is also high, you can draw more income from a Roth 401(k) account. In lower-income years, you can withdraw more income than is required from a traditional 401(k) account.

AMG CAN HELP WITH RETIREMENT AND TAX PLANNING

It can be difficult for individuals to understand the tradeoffs between a traditional and Roth 401(k), given how they affect current-year tax treatment of contributions and future tax treatment of distributions.

Find out more about AMG’s wealth management solutions, including Personal Financial Management (PFM) and Tax Services, or to book a free consultation call 303-486-1475 or email us the best day and time to reach you.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.