Colorado Mandates Retirement Savings Plans in 2023

• 6 min read

- Brief: Retirement & Benefits

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.

In 2023, Colorado joins a growing list of states requiring most businesses to offer an employer-sponsored retirement savings program, like a 401(k) plan or Simplified Employee Pension Plan (SEP). Most employers that don’t offer a workplace plan must enroll employees into a Roth IRA-based plan sponsored by the state called Colorado SecureSavings.

For small businesses contemplating whether to set up their own plan or use the government-run program, there is good news embedded within the SECURE Act 2.0.

There are now federal tax credits available to offset 100% of the qualified start-up costs for employers with up to 50 employees. For employers with 51-100 qualifying employees, there are similar credits available, capped at a lower amount.

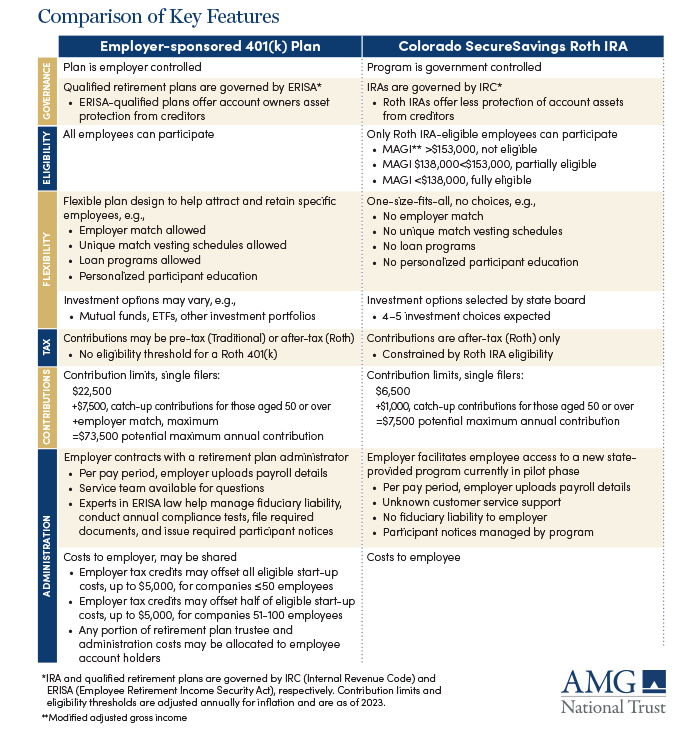

What are the advantages of a 401(k) plan vs. a Roth IRA?

- Broader Eligibility. A 401(k) plan can serve all employees. Contributing to a Roth IRA is limited based on tax filing status and income, phasing out at $138,000 for a single filer in 2023.

- More Flexibility. A 401(k) plan may be customized to your company’s unique needs to attract and retain key employees.

- Tax Options. A 401(k) plan may be designed with both Traditional (pre-tax) and Roth (after-tax) account options, with no income eligibility cutoff for Roth 401(k) participants.

- Higher Contributions. A 401(k) plan offers much higher retirement savings potential. The 2023 annual contribution limit is $22,500 for those less than 50 years old. A Roth IRA’s contribution limit is $6,500.

Here is a breakdown of the key features to consider:

WHY ARE STATES STARTING TO REQUIRE WORKPLACE RETIREMENT ACCOUNTS?

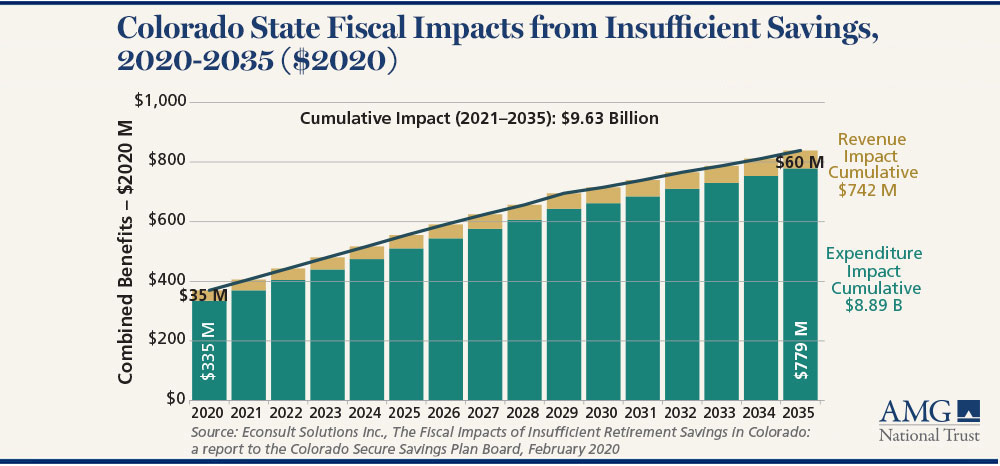

The Colorado Secure Savings Board estimates nearly 940,000 workers in the state lack access to an employer-sponsored retirement savings plan. The lack of workplace retirement savings accounts disproportionately affects employees at small businesses, young and minority workers, and lower-income earners.

Insufficient retirement savings negatively affect individuals and families, but also can have dire consequences for state economies.

For example, analysts estimate that an increase in expenditures on assistance programs and decrease in revenues from taxes on spending in local economies could result in an almost $10 billion negative impact on Colorado state’s budget over 15 years.

WHAT ARE THE KEY FEATURES OF THE COLORADO SECURE SAVINGS PROGRAM?

The Colorado Secure Savings Program went into effect on January 1, 2023, and the state’s mandate will start being enforced (with potential fines for non-compliance) in 2024.

- A Colorado employer in business two or more years with five or more employees and no current qualified retirement plan must facilitate employee participation in Colorado SecureSavings, which will be administered through automatic payroll deductions through existing payroll systems.

- Eligible employees will be auto enrolled in a Roth Individual Retirement Account (IRA) at 5% of pay with an automatic increase of 1% each year, up to a maximum of 8%. Employee participation is voluntary; employees may opt out, increase or decrease the contribution rate, or re-enroll at any time.

- Employers do not have to match contributions, nor are they considered fiduciaries. The Colorado Secure Savings Board acts as fiduciary, having discretion over the program’s design and the selection and monitoring of its investment options.

In case of noncompliance, employers may be liable to pay an annual fine of up to $100 per eligible employee per year, up to $5,000.

AMG IS AN EXPERT IN SMALL BUSINESS RETIREMENT PLAN ADMINISTRATION

Designing a 401(k)-retirement plan, administering it effectively, and keeping it compliant with changing laws is a daunting task for many employers.

But you don’t have to default to Colorado SecureSavings, the state-administered Roth IRA plan.

AMG can help Colorado businesses offer a more flexible plan specific to their participant population’s needs and those employees truly value, helping to attract and retain valuable talent.

Our comprehensive retirement plan solutions include:

- Colorado-based retirement plan specialists, centrally located in the Denver Tech Center

- Plan design and administration

- Independent investment advice

- Investment management and asset custody

- Participant education and online tools

- Ongoing compliance and annual report preparation (Form 5500)

- Trustee expertise for both qualified and non-qualified plans

NEED HELP DESIGNING A PLAN FOR YOU AND YOUR TEAM?

To book a free consultation with a retirement plan specialist call 303-486-1480 or email with the best day and time to reach you.

Frequently Asked Questions

A 401(K) plan offers broader eligibility, especially for higher earners; more flexible plan design to reflect the unique needs of a particular employer; the ability to offer pre-tax (Traditional) and after-tax (Roth) account formats; and much higher retirement savings potential with higher allowed annual contribution levels.

The Colorado Secure Savings Program offers payroll-based Roth Individual Retirement Savings Accounts (IRAs) to those without access to a qualified employer-sponsored retirement plan.

- A Colorado employer in business two or more years with five or more employees and no current qualified retirement plan must facilitate employee participation in Colorado Secure Savings, which will be administered through automatic payroll deductions through existing payroll systems.

- Eligible employees will be auto enrolled in a Roth Individual Retirement Account (IRA) at 5% of pay with an automatic increase of 1% each year, up to a maximum of 8%. Employee participation is voluntary; employees may opt out, increase or decrease the contribution rate, or re-enroll at any time.

- Employers do not have to match contributions, nor are they considered fiduciaries. The Colorado Secure Savings Board acts as fiduciary, having discretion over the program’s design and the selection and monitoring of its investment options.

- In case of noncompliance, employers may be liable to pay an annual fine of up to $100 per eligible employee per year, up to $5,000.

Colorado’s new retirement savings program is different from other states’ programs in two key ways:

- Colorado is the first state to mandate that all employers with at least five employees offer either a company-sponsored retirement plan or enroll employees in the state-sponsored plan. Fines for noncompliance may be $100 per employee per year up to $5,000.

- Colorado and New Mexico will be the first states to partner together and potentially lower shared administrative costs while also providing participants portability of their accounts when moving between states.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.