Retirement Planning: Is There a Best Age?

• 11 min read

Get the latest in Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

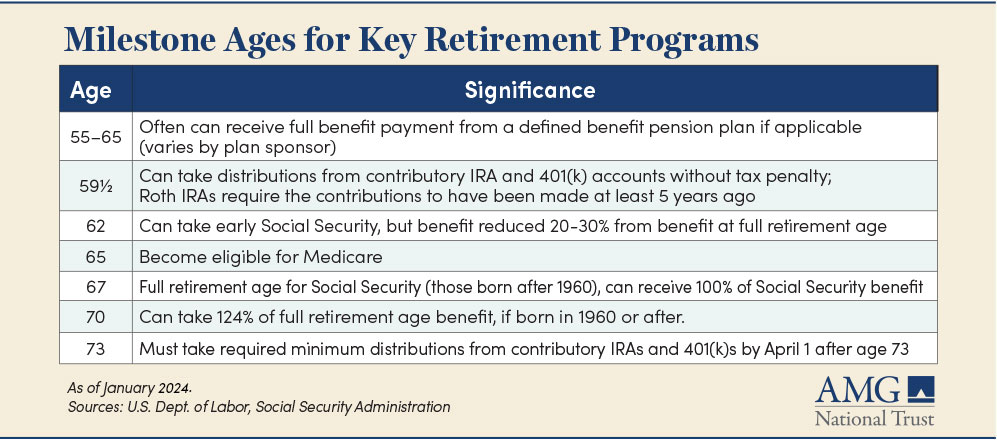

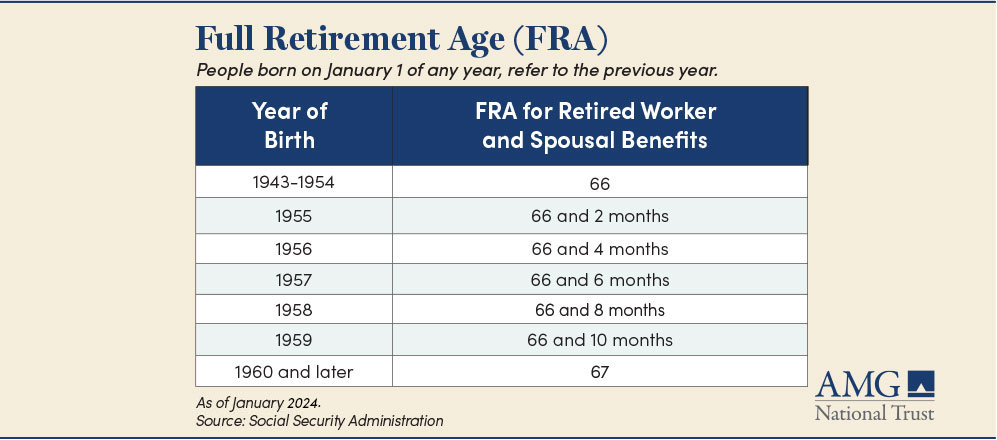

When is the right time to retire? Some believe there is an “ideal” age at which all the financial stars and years of preparation align. If so, it could be age 67—or full retirement age (FRA) for anyone born in 1960 or later—where you receive 100% of your monthly Social Security benefits. Or maybe it’s in your 40s or 50s, as the FIRE (Financial Independence, Retire Early) movement encourages. Then again, it could be in your 70s or later, if you enjoy what you’re doing and don’t plan to stop.

In reality, it is probably whatever time that your savings fit your financial/lifestyle goals and health needs.

Our free 7-page report on retirement planning aims to help you better prepare for your later years and enjoy them more by debunking common retirement myths.

65 IS NO LONGER THE MAGIC NUMBER

In the past, retirement decisions often centered around when an individual could qualify for Social Security or company-provided pension payments. But much has changed over the years.

While 65 was once the age at which one qualified for 100% of Social Security benefits, to account for gains in life expectancy, Congress in 1983 began gradually increasing it for people born in 1938 or later to a maximum of age 67.

Even so, on average, Americans are retiring earlier than that. Men retire at an average age of 64.6 years, and women at 62.3 years.

Social Security retirement benefits provide modest income (generally replacing only about 40% of pre-retirement income). In 2023, the uppermost annual Social Security benefits range from $28,000 for someone who files at age 62 to $50,000 for the person waiting till age 70—helpful, but certainly not adequate amounts for some lifestyles.

Additionally, its retirement trust fund is forecast to be depleted in about a decade. If nothing else changes by the early 2030s, FICA payroll taxes for Social Security may only be able to fund approximately 85% of retirement benefits.

Companies, meanwhile, have evolved from providing defined benefit pensions, often with mandated retirement ages, to offering defined contribution plans, e.g., 401(k) plans. With defined contribution plans, the onus is generally on you as the employee contributor to save enough or invest it properly—or decide when to start withdrawing income for retirement.

Your “ideal” retirement age is a deeply personal decision and depends on when you have adequate savings for the lifestyle that makes you happy, as well as other factors such as inflation, health, and life expectancy.

RETIREMENT AGE IMPACTS ITS QUALITY

Research from the National Bureau of Economic Research suggests that retirement improves health and life satisfaction, but the age at which you retire impacts the quality of that retirement.

Before picking your retirement date, consider:

- Social Security pays you to wait

- Life expectancy and health care needs

- Savings and expenses

- Inflation and volatility

- Quality of life

- Do you really want to retire?

Social Security pays you to wait

Social Security benefits remain a strong pillar of retirement planning despite concerns about projected solvency.

Typically, you can start receiving your monthly Social Security benefit at age 62. But there’s a catch: The amount you receive at 62 will likely be 20% to 30% less than the complete benefit you would receive at full retirement age, which Social Security sets at 67, if born in 1960 or later.

If your monthly benefit at full retirement age is $100, for example, the amount you’d get at 62 is probably only about $70, if born after 1960. You would only get the entire $100 if you start benefits at 67.

But Social Security becomes a much better investment if you’re at FRA but can wait until 70 to take your full benefit. For every year you delay after FRA to age 70, you can increase your benefit by up to 8%.

For example, if your FRA is 67 but you wait one year to retire, your monthly benefit will grow to 108% of what it was at FRA; at 69, 116%; and at 70 or later, 124%. There is generally no investment risk. Patience and smart retirement planning may be the only things you need. And your annual cost-of-living adjustment (COLA) is based on your benefit, so claiming a higher benefit should mean your COLA-adjusted benefit will be higher too.

That said, taking your benefit at 70 may not be your best choice. AMG provides clients with an analysis to determine Social Security options—and for your spouse, if married. Advisors provide guidance on how to elect benefits while taking personal situations and family health histories into consideration.

Life expectancy and health care needs

While you can never know how long you will live, you can shake the family tree for an educated guess. If most of your relatives are long-lived, the odds are that you will be too. Social Security estimates the life expectancy for men reaching age 65 on April 1, 2023, is age 84.1; for women, it’s age 86.8. You may choose to delay your retirement age to increase savings for that long haul.

On the other hand, health issues may force you to retire early. Health care remains one of the biggest expenses for retirees, potentially totaling about 15% of retirement expense. One study estimated that a 65-year-old couple retiring in 2022 could expect to spend an average of $315,000 on health care and medical expenses in their retirement. Perhaps more worrisome is that many Americans have wildly underestimated what those costs can be.

Another consideration is that when you retire, you not only lose a paycheck—you also may lose employer-provided health insurance. Although there are some exceptions, most people are not eligible for Medicare until age 65. If, for example, you retire at 62 for health reasons, how do you fill that health insurance gap until age 65?

Your employer should know whether you will have health insurance benefits after you retire or if you are eligible for temporary continuation of health coverage. If your spouse is employed, you may be able to switch to their health insurance. Otherwise, your best bet until age 65 may be private insurance versus the health insurance marketplace.

Savings and expenses

More than an ideal age, there may be an ideal number. The median American has around $65,000 in retirement savings but believes they will need at least at least $1.25 million to retire comfortably. That is quite a disparity.

It’s best to periodically review what you’re saving to be certain you’ll meet your goals. Tally the amounts in investments, an IRA or 401(k), and what you may receive from an annuity or pension benefits. You can get an accurate estimate by age of future monthly Social Security benefits by creating a personal account to access the calculator on the Social Security website. The sum of all those can give you a credible tally of your annual retirement income stream.

Next, determine how much money you would need annually to fund your lifestyle if you were to retire today. A rule of thumb is to multiply that number by 20 (for the average number of years you may live beyond age 65). For example, if your number is $100,000 a year, you would need $2 million in today’s retirement dollars. That is before factoring in inflation.

Now tally expenses, such as housing, health care, food, taxes, leisure, and travel. Use what you spend today, but be aware that as people age, spending patterns are likely to change. Starting at age 55, spending tends to increase slightly, as some younger retirees travel or take on new pursuits. Around 65, there potentially is a significant drop in overall spending.

Finally, will you be supporting children or grandchildren far into the future? Are education costs and student loans ongoing or paid off?

Inflation and volatility

Are you accounting for inflation? Generally, almost everything—from big-ticket items like houses to small things like a pack of gum—goes up in value over time. Your income will likely have to increase year over year just to maintain the same standard of living. At an inflation rate of 4% a year, prices double in just 18 years and at 3% a year, prices will double in about 24 years.

Volatility in prices and volatility in markets will always be with us, but they may not necessarily force you to bench retirement plans, provided that your investments are well-managed, and risk is diversified. A market shift up or down, though, may push you to adjust spending expectations.

Quality of life

What does retirement look like to you—will you be relaxing on the patio or sailing the seven seas? Maybe you’re OK living frugally, or are you thinking about spoiling the grandkids or buying that lakefront house you’ve had your eye on?

Where you want to live is also a consideration. If you hope to move, you’ll need to plan your expenses around the cost of living in that location. How far is it from family, and how often will you plan to visit?

Do you really want to retire?

If you enjoy what you are doing, why stop? With more companies allowing remote or flexible work arrangements, you may also have the time for travel or the other things you always talked about doing in your later years while still earning a salary and relying less on your savings. And if your latest year of earnings is one of your highest years, your Social Security benefit will be recalculated higher.

You can also choose to retire from one career but decide to start another or devote more time to volunteer and charity work. Continuing to work does not prevent you from also taking Social Security benefits. But if you are between age 62 and full retirement age and earn more than the yearly earnings limit, your benefit will be reduced. Beginning with the month you reach full retirement age, your earnings no longer reduce your benefits, no matter how much you earn.

Continuing to work also extends the time for you to max out contributions to a 401(k) or IRA. Penalty-free withdrawals can begin at age 59½; Required Minimum Distributions (RMDs) begin at age 73.

PREPARE FOR RETIREMENT SUCCESS

Your starting point for picking the ideal retirement age is a comprehensive financial analysis:

- See what your income and expenses might look like before and after retirement age

- Identify your short- and long-term liquidity needs

- Account for the potential risks associated with disability, death, or changes in your life situation

- Project your taxes and income into the future

- Determine an appropriate investment allocation to help meet your specific needs now and into the future

- View when and how to exercise your company stock options

Having the data laid out clearly using AMG’s five-year cash-flow and tax projections and long-time Financial Security Analysis may help you understand the choices available to you.

HOW AMG CAN HELP

AMG believes that retirement planning should be comprehensive, transparent, tailored to your specific goals and circumstances, and flexible enough to give you financial choices when life inevitably takes unexpected detours.

Most important, we know that it takes highly skilled professionals backed by a full slate of services to do the job right. We’ve been the trusted partner of individuals and families planning for retirement since we opened our doors in 1975.

To find out more about AMG’s Personal Financial Management (PFM) or to book a free consultation call 303-486-1475 or email us the best day and time to reach you.

REQUEST REPORT

Download this free 7-page report to reconsider eight common myths about retirement planning that may not be serving you.

Frequently Asked Questions

An analysis in the United States found about seven years of retirement can be as good for health as reducing the chance of getting a serious disease (such as diabetes or heart conditions) by 20 percent. Positive health effects of retirement have also been found by studies using data from Israel, England, Germany and other European countries.

- You are financially prepared.

- You have eliminated debt.

- You have a plan to cope with emergencies.

- You have health insurance.

- You have a social network.

- You have something else to do.

Financial planners often recommend replacing about 80% of your pre-retirement income to sustain the same lifestyle after you retire.

A 35-year-old earning $60,000 would be on track if they have saved about one year of income, or $60,000. Most 50-year-olds would be on track if they’ve saved about five times their income.

The Social Security Administration calculates your monthly benefits by looking at how much you’ve earned throughout your life. The amount will be higher the longer you wait to apply, up until age 70.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.