Boom Time Comes With Inflation Risks

• 3 min read

- Brief: Global Economy

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.

COVID-19 has suppressed aggregate demand for goods and services for nearly a year, leading to a large accumulation of pent-up demand. Despite a subpar economy, consumers are in good financial shape. Extended unemployment benefits and cash grants, together with suppressed consumption, have sent savings levels up and debt levels down. As the portion of the population vaccinated expands and herd immunity is approached, demand for goods and services should be expected to surge. In addition, both fiscal and monetary policy are strongly expansionary today.

The output gap between current economic production and its upside potential remains large and is probably not going to close before late 2023. Even so, demand growth on steroids obviously raises inflation risks—and not just for the long run. There is a very high likelihood that inflation will experience a spike in 2021 for two main reasons: 1) annual inflation will be calculated from a low base level, and 2) a rebound in demand for goods and services is likely to outstrip current production capabilities.

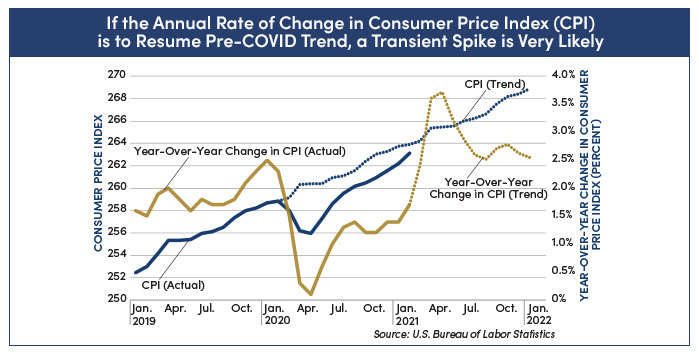

Leading up to the pandemic, year-over-year headline CPI inflation was averaging 1.96 percent. ‘The Great Shutdown’ resulted in a few months when CPI fell as certain categories of consumption experienced temporary deflation. If medium-term inflation is to normalize near its pre-COVID trend, the economy will likely experience a couple of months when CPI readings indicate inflation rate above three percent. The precise shape of the coming spike is difficult to foretell, but it will likely prove transitory and dissipate once the economy steadies.

The Consumer Price Index (CPI) dropped precipitously last spring, meaning the denominator in the calculation of any rate increase since then will be quite depressed. So, the reported rate (i.e. inflation) will be commensurately increased. Only small monthly increases are needed through May to push annual CPI inflation to 3%. That effect will fade moving into the summer months. However, COVID-19 induced layoffs disrupted supply chains, mothballed equipment and facilities, lightened inventories, and reduced investment in affected industries. All will create production difficulties, and hence price increases. Recent reports of semiconductor shortages in vehicle manufacturing, spot labor shortages in some rebounding service industries, and spiking prices in lumber and certain raw industrial metals, are some manifestations of the production issues that may well escalate as demand rebounds.

It is widely anticipated that most production constraints will be short-term in nature, but that is not certain. Also, as the full extent of such problems is not known with precision, they pose an upside risk to longer-term inflation. Shifts in the composition of demand could, for example, result in a long and complex restructuring of production processes. That, compounded by excessively stimulative economic policies, could result in an early return to accelerating trend inflation, for which AMG will be diligently scanning the horizon.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.