Financial Planning Considerations During Open Enrollment

• 12 min read

- Brief: Wealth Management

Get the latest in Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

Health care and planning for retirement may be two of the most important decisions that you will make for your family.

Fortunately, most employer-sponsored retirement plans allow you to make changes at any time. But health coverage and other benefit selections are bound by the choices made once a year—during the annual Open Enrollment Period (OEP)—and likely deserve more thought.

Rather than absently renewing the same selections each year, ask yourself whether you are making the best use of payroll deductions and are maximizing your employee benefits, which typically include health insurance, group life and disability insurance, and access to tax-advantaged retirement savings plans.

Other than for a qualifying life event—such as marriage, divorce, birth/adoption, or loss of health insurance—the only time you can add or change health coverage is generally during the annual OEP.

For coverage in 2024, the federal OEP runs from November 1, 2023, through January 15, 2024. (A decision is required by December 15 if you wish coverage to begin on January 1. Otherwise, coverage will start February 1 for those who enroll in or change plans by January 15 and pay the first premium.)

The deadlines may vary for individuals purchasing coverage through their employer or a state-run exchange.

HOW TO DECIDE AMONG HEALTH PLANS?

Certainly, cost will be part of the equation when choosing a health plan, including both employee contributions and out-of-pocket expenses. Yet there are often tax advantages to integrating your benefits choices with your overall financial plan.

For health plans, it’s important to evaluate your medical needs, such as specific treatment or prescriptions, and which health coverage option best meets those needs.

These are some general health questions for you to consider:

- What type of health needs do you anticipate in the coming year?

- Can you use in-network physicians, or do you need the flexibility to see specialists?

- How much cash flow do you have for monthly insurance premiums?

- What amount of out-of-pocket costs or deductible can you manage?

- Do you have the cash flow and option to invest in a Health Savings Account (HSA)?

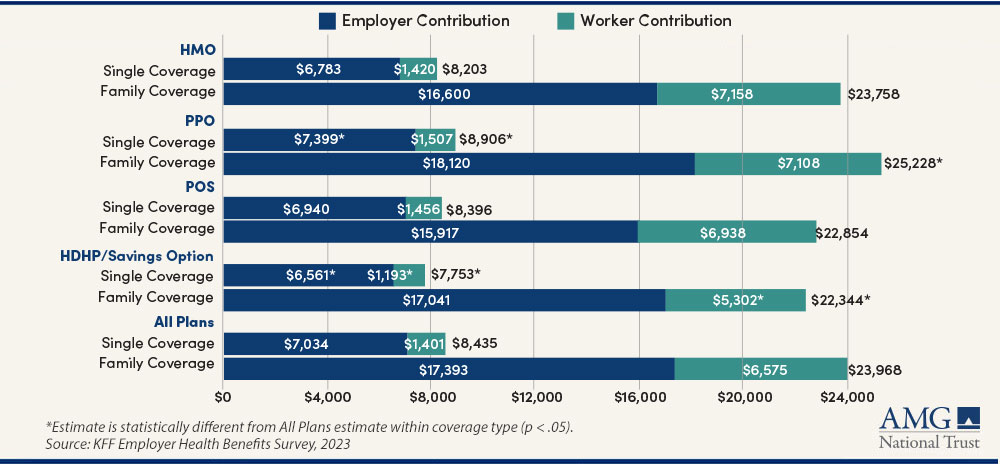

Health Insurance Premiums Are Rising

Spending on health care is expected to reach $4.7 trillion in 2023. That translates into higher costs for families. According to the Kaiser Family Foundation, the average premium for family coverage has increased 20% over the last five years and 43% over the last 10 years.

This may lead your employer to change the percentage of the bill they cover, increasing what employees pay. Therefore, it’s a good idea to shop among not only your employer’s offerings, but other types of plans for ways to decrease monthly insurance premiums and out-of-pocket costs.

Average Annual Worker and Employer Premium Contributions

Single and family coverage by plan type, 2023

HEALTH INSURANCE PLAN TYPES

Health providers’ plans will vary in flexibility, services offered, and cost. Understanding the basic features can help you select the best option for your family’s medical needs.

HMO

A Health Maintenance Organization (HMO) plan can provide a wide range of health care services, but you must choose from physicians and other providers who work for or have a contract with the HMO. In return, you may pay lower monthly premiums and out-of-pocket costs. Typically, a referral from your primary care physician is required for you to see a specialist. Visits to a physician outside the HMO network will likely be your financial responsibility, with exceptions for medical emergencies.

An HMO also may allow each patient only a certain number of annual visits, tests, or treatments.

PPO

A Preferred Provider Organization (PPO) plan offers more flexibility to see physicians out of network and specialists without a referral. This flexibility comes with a price: generally higher monthly premiums and out-of-pocket costs. In some cases, you may have to pay directly for out-of-network services and file a claim to be reimbursed, though there may be exceptions for medical emergencies.

POS

A Point of Service (POS) plan is an HMO/PPO hybrid, offering cost savings for using in-network providers yet also generally covering an out-of-network specialist at in-network pricing if your primary care physician provides a referral. Medical emergencies are covered regardless of network. Monthly premiums may be higher than for either HMO or PPO plans.

HDHP/SO

A High Deductible Health Plan with Savings Option (HDHP/SO) typically saves the most in monthly premiums, but as name suggests, the insured will have to pay more for health care costs before the insurance company starts to pay its share.

For 2023, the Internal Revenue Service (IRS) classifies an HDHP as any plan with an annual deductible of at least $1,500 for individuals and $3,000 for a family. Total annual expenditures—such as deductibles, copayments, and coinsurance—cannot exceed $7,500 for individuals and $15,000 for a family.

This may be an attractive option for relatively healthy people who do not use a lot of medical services and who would benefit from access to a triple-tax-free savings account, the HSA.

HSAs

Health Savings Accounts (HSAs) are a unique financial planning tool, as they offer a triple tax advantage. Contributions are made pre-tax, appreciation is tax-free, and spending is tax-free, so long as the funds are if used for qualified medical expenses. Also, your account has the potential to grow through investments in stocks, bonds, ETFs, mutual funds, or other options. Spouses can each have an HSA, but both cannot contribute to a single account.

Money that is not used in a calendar year can be rolled over indefinitely without penalty. And at age 65, the money is eligible for non-qualified medical expenses, though the withdrawal would be subject to ordinary taxes.

As such, an HSA can be a compelling long-term savings vehicle. But it is available only to those enrolled in an HDHP.

As of mid-2023, about 36 million accounts held $116 billion in HSA assets, according to Devenir.

HRAs

Health Reimbursement Arrangements (HRAs) are another option with high-deductible plans. Employees are reimbursed by employers tax-free for qualified medical expenses up to a fixed dollar amount.mployees per year, and employees are reimbursed tax-free for qualified medical expenses. Funds remaining at the end of a year can be rolled over to the next year.

Contributions and Out-of-Pocket Limits for HSAs and HDHPs

| 2023 | 2024 | |

|---|---|---|

| HSA contribution limit (employer + employee) | Individual: $3,850 Family: $7,750 | Individual: $4,150 Family: $8,300 |

| HSA catch-up contributions (age 55 or older) | $1,000 | $1,000 |

| HDHP minimum deductibles | Individual: $1,500 Family: $3,000 | Individual: $1,600 Family: $3,200 |

| HDHP maximum out-of-pocket amounts (deductibles, copayments, and other amounts, but not premiums) | Individual: $7,500 Family: $15,000 | Individual: $8,050 Family: $16,100 |

Health FSAs

Health Flexible Savings Accounts (FSAs) are generally available to those enrolling in HDHPs and non-HDHPs. They share some similarities to HSAs in that they offer tax advantages so long as they are used for qualified medical expenses.

Most FSAs have a “use it or lose it” feature. You may be allowed to carry over a limited amount of unused funds to the new year—but only for 2.5 months into the new year. Any money above that amount generally reverts to your employer. Also, your employer essentially “owns” your FSA. You forfeit any remaining funds if you leave that job.

An FSA may be an attractive option for someone requiring a low-deductible health plan because they expect medical expenses during the year. A feature that may make this even more desirable is that your funds are immediately available to you on day one of your plan year.

For example, if you plan to contribute $500 per month for a total of $6,000 per year…

- An HSA allows you to access only the amount you have already contributed;

- An FSA account owner can access the entire $6,000 at the start of the year, regardless of the actual amount in the account.

Flexible Spending Accounts

| 2023 | 2024* | |

|---|---|---|

| Contribution limit | $3,050 | $3,200 |

| Carryover limit | $610 | $640 |

*These are projections for 2024. The IRS has not yet released the official contribution limits.

Group Insurance Coverage

This is generally low-cost coverage offered to a large group of people, such as to the employees of a company. About two-thirds of Americans use this coverage as their life insurance lifeline. However, nearly half of recipients say they don’t fully understand everything about the coverage.

Group Term Life Insurance

Group life coverage is sometimes referred to as supplemental life insurance, as it generally offers protection additional to an individual life insurance policy. For this reason, people may also buy an individual permanent or term policy.

Some aspects of group term life insurance include:

- The employer generally pays all or most of the cost of group life coverage.

- You may not be required to take a medical exam.

- You may lose coverage if you leave your job unless the policy is portable and allows you to continue the policy at your own cost.

Disability Insurance

The risk of becoming disabled is more common than many may realize. Over a quarter of adult working Americans can expect to experience a disabling injury or illness, according to the Centers for Disease Control and Prevention.

The impact of a disability on your ability to earn income and the increased spending on care can be financially devastating. The financial impact has forced one in four adults age 18 to 44 with disabilities to endure an unmet health care need because of cost in the past year.

Disability income insurance generally replaces up to 70% of income, and can be divided into two types:

- Short-term disability. This insurance pays benefits, generally for up to six months. The money comes to you directly.

- Long-term disability. The benefits paid out for total long-term disability often are measured in years or a lifetime. In contrast, partial long-term disability plans help when you are not completely disabled but lack the full physical capacity to fulfill your job.

Advisors generally recommend that you take full advantage of employer-provided group insurance policies, as they are often free or low-cost to the employee. It’s often advisable to supplement them with individual coverage. Group plans may consider only your base salary to determine benefits and exclude commissions or bonuses, which can be problematic for high-income earners.

Individual policies can increase your total asset protection and may also be more flexible and customizable. For example, you could purchase an “own-occupation” policy, which pays full benefits if you cannot work your specific job, but also allows you to seek employment elsewhere. Doctors frequently purchase own-occupation policies.

Voluntary Pre-Tax Payroll Deductions

A rule of thumb during the open enrollment review of your benefits package is that if your employer offers a pre-tax payroll deduction for a service you would use anyway, opt in. Doing so can save you a pretty penny as the value of the benefit is deducted from your gross pay before taxes are paid, lowering your taxable income.

In addition to the Health FSAs and HSAs discussed above, voluntary pre-tax benefits could also include:

- Dependent Care Flexible Spending Accounts

- Commuter Benefits

- Adoption Assistance

- Educational Assistance

- Retirement Planning Services

Another Potential Payroll Deduction: Retirement Plans

Most retirement plans have no annual time limit to enroll or adjust holdings. But if you already are tinkering with health care choices and other benefits, the open enrollment period is also a good reminder to review how you are managing your retirement plan contributions and beneficiaries too.

General rules of thumb

Maximize employer contribution. If an employer match is available for your 401(k) or SIMPLE Individual Retirement Account (IRA), are you contributing enough each pay period to meet that match? Does your cash flow allow a higher annual contribution? Is your level of savings on track with your overall financial plan?

Note that if you are a high-income earner, your company may cap the percentage of total salary you can contribute. For instance, if you earn $250,000 and your contribution cap is 7%, you can contribute just $17,500, which is less than the total amount allowed by the IRS. In such a situation, you may choose to open another account such as a Roth 401(k), if offered by your employer, or open a traditional or Roth IRA for an additional tax advantage

Qualified Account Contribution Limits

| Account Type | 2023 | 2024* |

|---|---|---|

| 401(k) traditional or Roth, 403(b), 457 (employee limit) | $22,500 | $23,000 |

| IRA (traditional or Roth) | $6,500 | $7,000 |

| SEP IRA | $66,000, or 25% of employee’s compensation | $68,000 |

| SIMPLE IRA | $15,500 | $16,000 |

*These are projections for 2024. The IRS has not yet released the official contribution limits.

Save early, save often. About six in 10 baby boomers and nearly seven in 10 Gen Xers said in a recent survey they aren’t prepared financially to retire. Listening to those voices can be a lesson about the need to maximize retirement savings.

That same survey held a glimmer of hope. About 25% of workers said they were putting more money into their retirement accounts in 2023 versus 2022. As you do your year-end retirement review, look for unexpected savings in your budget that can go into your retirement account.

If you are age 50 or older, do not overlook catch-up contributions. Catch-up contribution limits from 2023 are expected to hold steady in 2024 at $7,500 for 401(k)s and $1,000 for traditional and Roth IRAs.

Related Article: Breathing Room on High Earner Catch-up Contributions

Diversify your accounts. Contributing to both traditional and Roth 401(k) accounts offers flexibility in the future to time distributions from your accounts to potentially manage when and how much you pay in required taxes.

Related Article: Breathing Room on High Earner Catch-up Contributions

HOW AMG CAN HELP

AMG’s Personal Financial Management (PFM) can help you make informed wealth management decisions. Our Executive Financial Counseling services can conduct a rigorous analysis of your company-sponsored plans and programs, including defined benefit, defined contribution (401k), deferred compensation, employee stock purchase, stock options, and insurance. We can provide tax minimization strategies, as well.

To find out more about how AMG can help you reach your financial goals or to book a free consultation, call 303-486-1475 or email us the best day and time to reach you.

Frequently Asked Questions

- What type of health needs do you anticipate in the coming year?

- Can you use in-network physicians, or do you need the flexibility to see specialists?

- How much cash flow do you have for monthly insurance premiums?

- What amount of out-of-pocket costs or deductible can you manage?

- Do you have the ability to invest in an HSA?

Most retirement plans have no annual time limit to enroll or adjust holdings, but the annual open enrollment period for employee benefits can be a reminder to review your retirement contribution level and potential diversification among your accounts.

In addition to health insurance, other benefits that your employer may offer include group life coverage, disability insurance, commuter benefits, adoption assistance, educational assistance, and retirement planning services.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.