Benefits of Spousal Lifetime Access Trusts (SLATs)

• 8 min read

Get the latest in Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

Spousal Lifetime Access Trusts (SLATs) can be an effective estate planning tool for certain high-net-worth individuals and families to help lower federal estate tax and transfer wealth efficiently to heirs.

Many individuals are averse to moving forward with advanced estate planning techniques because they are intimidated by their complexity or fear that someday they may need the gifted assets for their use.

Using a SLAT instead of other trust types can often address these concerns.

WHAT IS THE PURPOSE OF A SPOUSAL LIFETIME ACCESS TRUST?

- A spousal lifetime access trust (SLAT) is an irrevocable trust created by one spouse for the benefit of the other spouse and family members (children and/or grandchildren).

- Couples of significant means can maximize the historically high federal gift and estate tax exemption ($12.92 million per person in 2023) by making planned gifts while still alive, lowering each donor spouse’s taxable estate.

- Although gifts are irrevocable, a spousal trust offers some financial flexibility as the beneficiary spouse may use distributions to pay for household expenses.

- At the beneficiary spouse’s death, both the principal gift and subsequent appreciation may be passed free of estate taxes to children, grandchildren, or other named descendent beneficiaries.

Using SLATs to gift $20 million tax-free

A couple with $20 million collectively decides that neither would need more than $10 million to fund their desired lifestyle if the other passes away. They each create a $10 million SLAT using most of their lifetime gift tax exemption and naming the other as the primary beneficiary.

If they both live 10 more years and the assets double in that time, they will have removed from their taxable estates both the gifted $20 million and the $20 million of appreciation.

Under current law, assuming the exemption amount increases 3% annually, this strategy would save the couple about $9 million in transfer taxes.

WHY USE A SPOUSAL LIFETIME ACCESS TRUST?

1. Maximize historically high lifetime gift and estate tax exemptions

While SLATs have been around for decades, there was a resurgence in their use after Congress increased the lifetime gift tax and estate tax exemption from $1 million to $5 million in 2011 and to $11.28 million in 2018 (inflated to $12.92 million in 2023).

The current historically high exemption offers unprecedented opportunities for high-net-worth families to avoid estate tax when maximizing the current exemption amount. Planned gifts also lower transfer tax exposure, including generation-skipping transfer tax when planning gifts to grandchildren.

Exhibit 1: Recent Lifetime Estate Tax Exemption Is Historically Anomalous

If no action is taken by Congress, the higher exemption established by the 2017 Tax Cuts and Jobs Act will revert to $5 million (adjusted for inflation) in 2026. However, increasingly there is concern that tax laws will change sooner as Congress looks for ways to pay for increased fiscal spending.

2. Retain indirect access to trust assets

A SLAT is a third-party trust, not a self-settled trust, which means the grantor cannot be a beneficiary. However, the grantor’s spouse can be the primary beneficiary. The beneficiary spouse can voluntarily distribute income to the grantor by using distributions to pay for household expenses.

The trust language defines how SLAT principal and income may be distributed. A SLAT may be a discretionary trust in which the trustee exercises “sole and absolute discretion” or a support trust that restricts distributions to specific uses such as health, education, maintenance, and support (HEMS).

The beneficiary spouse may serve as sole trustee or co-trustee with an independent party. In the case of a discretionary trust, a corporate trustee is appointed to make distribution decisions, generally. In the case of a support trust, many include a “spendthrift provision” to deter misuse of trust property by a beneficiary. In either a discretionary or support trust, the donor spouse could retain the first power to remove and replace the trustee.

Because administering trusts is complex, many families find it helpful to appoint an independent trustee or an independent co-trustee with the beneficiary spouse. As a corporate trustee, AMG often serves in these roles for clients.

3. Grow trust assets tax-free

Assets transferred to the trust are no longer considered to be part of the taxable estate of either spouse. Therefore, any future appreciation in trust assets may be considered estate tax savings.

Although a SLAT can be funded with a variety of assets, many choose to gift assets that have high appreciation potential and those with the lowest tax basis.

A SLAT also can hold the grantor’s life insurance policy, but there cannot be any incidence of grantor ownership in the life insurance.

4. Pass wealth to descendent beneficiaries tax-free

SLAT assets are kept separate from the beneficiary spouse’s other assets should he or she remarry and are excluded from the beneficiary spouse’s estate upon his or her death.

At the beneficiary spouse’s death, remaining SLAT assets pass free of federal estate taxes to the grantor’s descendent beneficiaries, which may include grandchildren. These assets can be distributed outright or held in a separate trust for each descendent.

5. Protect assets from creditors

Assets held in third-party, irrevocable trusts can be safe from the grantor’s creditors if the transferring assets are not considered a fraudulent conveyance to hinder, deny, or defraud creditors.

Depending on the terms of the SLAT governing documents and how the spousal trust is administered, assets may be protected from claims made by the beneficiary spouse’s creditors and those of family beneficiaries.

6. Transfer more wealth than lifetime gift and estate tax exemption

Many trusts are taxed as persons and must file and pay state and federal income taxes. However, SLATs are often set up as Intentionally Defective Grantor Trusts (IDGTs), which are typically trusts where the grantor is the owner of the trust assets for income tax purposes but has relinquished ownership for estate tax purposes.

In such cases, taxes on income generated are paid by the donor spouse using the donor’s tax bracket, not by the trust using the trust’s tax bracket or the beneficiaries.

This is beneficial to the trust as its assets may compound faster. It also transfers more money out of the donor spouse’s taxable estate, gift-tax-free. Therefore, the taxes paid by the grantor may be considered additional tax-free contributions to the trust.

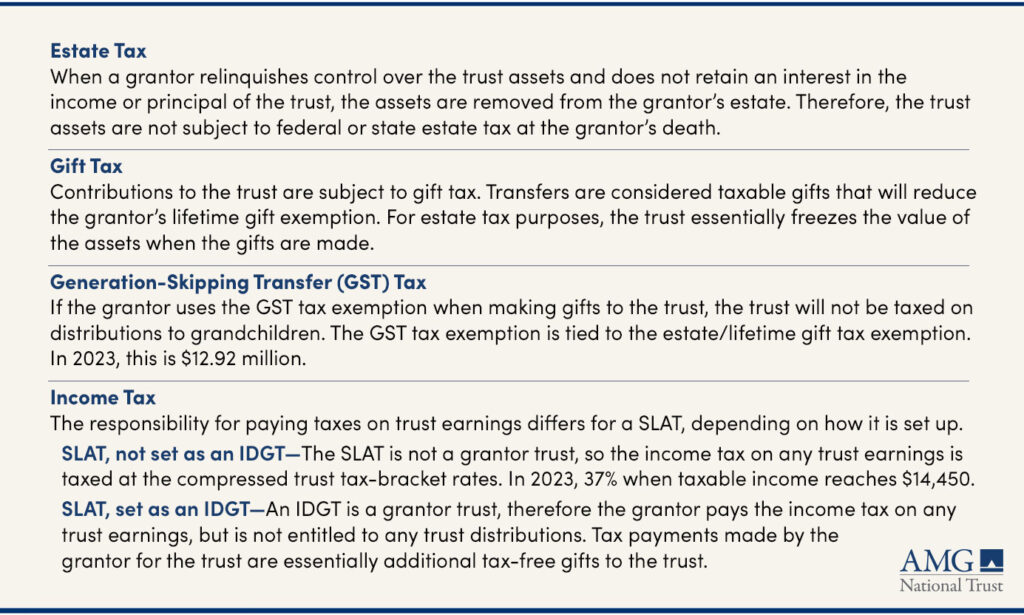

Exhibit 2: Taxation of SLATs and IDGTs

WHEN NOT TO USE A SPOUSAL LIFETIME ACCESS TRUST?

Divorce or early death of a beneficiary spouse

SLATs are less suitable when the beneficiary spouse becomes divorced from the donor spouse or when the beneficiary spouse dies before the grantor. In both scenarios, the donor spouse will lose indirect access to the trust.

Potential problems arising from divorce can be avoided if proper safeguards are included when writing the SLAT document. Such precautionary provisions may include:

- define the beneficiary spouse as the grantor’s current spouse

- terminate the trust upon divorce, with the trust assets dropping down into individual trusts for the non-spouse beneficiaries.

For an existing SLAT, how assets will be treated should be addressed in the divorce terms. SLATs should be made compatible with marital agreements (prenuptial or post-nuptial), generally.

It is probably not a good idea to create a SLAT if marital difficulties exist or if the beneficiary spouse is in poor health with a life expectancy considerably less than the donor spouse.

HOW CAN SLATS FAIL?

1. Reciprocal trust doctrine

When creating a separate SLAT for each marital partner, use caution to avoid infringement of the IRS reciprocal trust doctrine.

If two SLATs are determined to be reciprocal (identical), the trust assets will fall back into the grantor’s estate and be subject to estate taxes, which would nullify the tax benefit of the original gift.

Generally, there are methods attorneys employ to establish different aspects of the SLAT for each spouse, for example:

- Set up the SLATs at different times

- Place different assets in each trust

- Create different distribution standards

- Use different states for governing and administering the trusts

- Establish different powers of appointment over trust assets.

2. Gifting joint assets

The grantor should fund the SLAT only with separate property assets. Do not use assets held jointly with the beneficiary spouse, as this may be construed as the beneficiary spouse making a gift to the trust. Avoid gift splitting, as well.

Similarly, “community property” assets should not be used for funding. Before community assets are contributed to the SLAT, they need to be divided into separate property assets.

When using the lifetime gift exemption, file a gift tax return, to authenticate the timing and the amount of the gift.

Exhibit 3: SLATs from the Perspectives of the Three Parties to a Trust

IS A SPOUSAL LIFETIME ACCESS TRUST IN YOUR FUTURE?

The SLAT offers a variety of estate-planning benefits—for the right couples.

Before contacting an estate-planning attorney to draw up spousal lifetime access trust documents, you should assess:

- your and your spouse’s health

- your marital strength

- the assets you can comfortably place out of reach

- which assets are expected to appreciate most over time

- the amount of control you want to give your beneficiaries.

It is important to remember that a SLAT is not a stand-alone technique. It should be built into your overall estate plan.

To achieve the best outcome, you should work closely with your AMG financial advisor, a tax professional, and an experienced estate attorney.

At AMG, we specialize in integrated, holistic Personal Financial Management (PFM), acting as a trusted wealth advisor and counselor as your life circumstances change.

To book a free consultation call 800-999-2190 or email us the best day and time to reach you.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.