Financial “Baby Steps” When Planning to Start a Family

• 9 min read

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.

Starting a family is exciting and life-altering. It also can be emotional and stressful. Expensive, too. From birth through their 17th year, it’s estimated that parents will spend about $310,605 per child.

Though you can never fully anticipate every “adventure” that may come with raising a family, you can still be prepared, for example, by exploring how to maximize your money, utilize insurance and tax options, and design your legacy with an estate plan. Our special report on 9 Financial Planning “Baby Steps” to Consider When Starting a Family outlines practical financial steps that can help set your family up for success.

After all, if you are a new parent, you probably already would expect to be up all night tending to a crying newborn. You shouldn’t also be kept awake by worries of a financial nightmare.

PUT FAMILY ON FIRM FOOTING

When you’re expecting, some preparations come to mind: preparing the baby’s room, picking a stroller and car seat, or perhaps shopping for a larger vehicle. You’ve likely also tackled other basics, such as working up a budget, adding life insurance, and paying down debt. Those items are a good start, but there are still other elements to juggle.

- Update Your Health Care Plan

- Health Savings Account

- Flexible Spending Account

- FSA for Child Care Expenses

- Child Tax Credit

- Reassess Your Retirement Contributions

You’ll also want to consider how to distribute your hard-earned assets through an estate plan.

- Will or Revocable Trust with Pour-Over Will

- Durable Power of Attorney and Living Will

- Estate Planning Letter of Intent

- Estate Tax Obligations

- Update Beneficiaries

MAXIMIZE CAREER EARNINGS AND GROWTH POTENTIAL

When we hear the phrase “career earnings,” we may think only about how much a job pays. But a wider view is increasing the bottom line by taking advantage of pre-tax benefits or tax credits, especially when having or adopting a baby qualifies you for new programs. Some options for doing so are:

Update Your Health Care Plan

Having or adopting a baby is a qualifying life event, which enables you and your spouse or partner to change your health plan elections. Typically, most plans require that you add a new child to a plan within 30 to 60 days after the event. If done in the time frame appropriate for your policy, your child should be covered retroactively.

If you and your spouse or partner have employer-sponsored options available to you, choose the one offering the most coverage for the least out-of-pocket expense. You may not want a high-deductible, low premium plan in your baby’s first year because of the potential for complications and unexpected office visits. However, coupling a high deductible with a Health Savings Account can offer tax advantages.

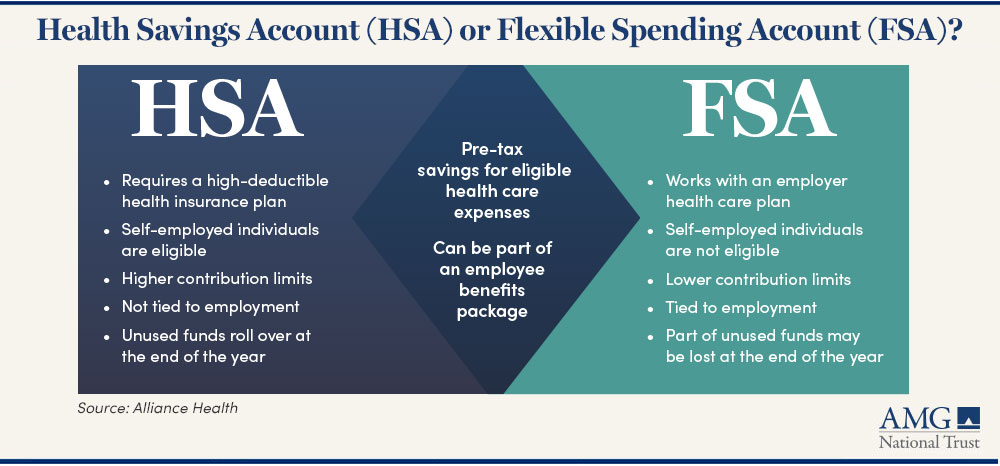

Health Savings Account (HSA)

A Health Savings Account is available only to those purchasing a qualifying high-deductible health plan. Contributions are considered “above-the-line” (deducted from adjusted gross income). For 2024, you may contribute $4,150 for individual coverage and $8,300 for family coverage. Anyone 55 or older can contribute an additional $1,000. When you fund your HSA, you may have the option to also invest those funds, with gains/losses impacting the balance. Any money left in your HSA at the end of the year will roll over to the next year.

HSAs have several tax advantages: contributions are pre-tax, all interest earned from investments is tax deferred, and distributions are not taxed so long as they are used to pay for qualified medical expenses.

Flexible Spending Account

A Flexible Spending Account for health care services may be offered by employers and is funded through employer contributions or employee pre-tax payroll contributions. For 2024, employed spouses may each contribute up to $3,200, of which $640 may be carried over to the following year if the employer plan permits. Otherwise, any remaining funds may be forfeited.

FSA for Child Care Expenses

An FSA also can be used for services such as nannies, daycare, preschool, and before or after school programs for children up to age 13.

One such option is a Dependent Care Flexible Spending Account (DC FSA), funded from a pre-tax payroll deduction. The contribution limit for 2024 is a combined $5,000/year for single filers or for married couples filing jointly ($2,500 if married but filing separately). Expenses reimbursed through a funded Dependent Care FSA cannot be claimed again as a Child and Dependent Care Tax Credit, which effectively reimburses up to $3,000 for one child or $6,000 for multiple children in eligible childcare expenses.

Child Tax Credit

The Child Tax Credit is available to parents for each qualifying dependent child under the age of 17 and reflects that families with children will likely have more expenses. It is separate from the Child and Dependent Care Tax Credit.

Families may be eligible for a tax credit of $2,000 per qualifying child.

A family adopting a child can claim the Adoption Tax Credit, which amounts to a maximum of $16,810 per child for 2024. Also explore whether your employer offers parental leave after a birth or adoption.

Reassess Your Retirement Contributions (Traditional vs. Roth)

There can be trade-offs among contributions to a traditional Individual Retirement Account (IRA) or 401(k) and a Roth IRA or 401(k). IRAs generally offer more investment options, while the potential employer match of employee contributions to a 401(k) can be considered free money. If your income is low today but you expect it to grow, a Roth option may be beneficial. If your income is high today, you may want to examine the pre-tax treatment of traditional options.

| Account Examples | Traditional 401(k) | Roth 401(k) | Traditional IRA | Roth IRA |

|---|---|---|---|---|

| Tax Treatment | Contributions can lower taxable income in the year they are made. Distriutions in retirement are taxed as ordinary income. | No immediate tax benefit. Withdrawals can be tax-free if the account is at least five years old and the account holder is at 59 and a half or older. | Contributions can lower taxable income in the year they are made. Distributions in retirement arae taxed as ordinary income. | No immediate tax benefit. Withdrawals can be tax-free if the account is at least five years old and the account holder is at 59 and a half or older. |

| Contribution Limit | $23,000 in 2024 ($30,500 if age 50 or older.) | $7,000 in 2024 ($8,000 if age 50 or older.) |

||

| Employer Match | Many employers offer a match, typically around 3%. | None | ||

DESIGN YOUR LEGACY

If something were to happen to you, consider how you would want loved ones to be cared for. Consider, too, that end of life planning is about more than the value of your estate. It’s also about the legacy you hope to leave.

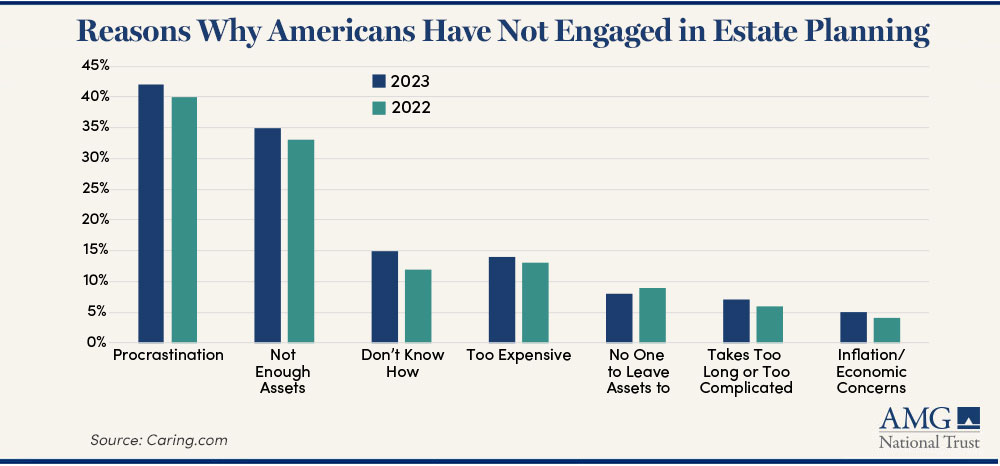

Estate planning deals with tangible assets (such as property or money), while legacy planning involves the intangibles (such as philanthropy or passing on values or mementos and the stories behind them). Your guidance on these difficult discussions can help ease the burden on loved ones. Yet 2 out of 3 Americans do not have any type of estate planning document.

YOUR ESTATE PLAN

Even if you have not yet accumulated substantial assets, estate planning documents are important tools that help to make terrible events more manageable.

Having a minor in your household increases the need for documentation that communicates your desires for how they should be raised and smooths the transition of financial support.

A typical estate plan includes:

Will or Revocable Trust with Pour-Over Will

The difference between a stand-alone will in transferring assets to the named and a pour-over will is that a will is meant to handle your entire estate, such as by leaving it to your spouse or your kids. A pour-over will exists only to move assets into a trust. A revocable trust with a pour-over will has an advantage over a stand-alone will in that assets will be transferred to the named beneficiaries of the trust without having to go through probate court, which may publicly discloses assets, can take time, and can incur fees. Revocable trusts are flexible and may be amended as needed, only converting to fixed, irrevocable trusts at the death of the grantor.

It’s also important to designate a guardian for minors. If you have complicated assets or instructions for the care of your child, you may wish to designate a corporate trustee who is a regulated fiduciary with extensive professional knowledge to efficiently carry out the terms of the trust until your child reaches a certain age.

Durable Power of Attorney and Living Will

A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a POA is durable, it remains in effect if you become incapacitated, such as due to illness or an accident.

Durable powers of attorney help you plan for medical emergencies and declines in mental functioning and can ensure that your finances are taken care of.

Another element is a living will (also known as an advance health care directive) that states your wishes for end of life care.

Estate Planning Letter of Intent

This is not a legal document, but it is a useful way to communicate your intentions to your loved ones and possibly to a probate judge, should your estate go through that process. Instructions can include your memorial service and disposition of remains, or how you envision your children’s future.

Many also choose to write down their wishes regarding how they want to be treated by the health care system. Doing so also can clearly halt situations where loved ones are at odds over your care. The National Institute on Aging provides free publications that can help you and loved ones discuss key issues around life wishes.

Estate tax obligations

Although you’ve probably heard dire statements about the estate tax, the truth is that the vast majority of estates will not owe any federal estate tax. In 2024 the federal estate tax exemption is $13.61 million for an individual or $27.22 million for a married couple.

Still, if you are anywhere near this number, you should have your bases covered. Find out whether your state has death or inheritance taxes that might affect your estate; some states have a lower threshold amount than for federal estate taxes.

Update Beneficiaries

You should periodically check your beneficiary and contingent beneficiary designations on all your financial accounts, e.g., banking, investments, and insurance. For the sake of your beneficiaries, it’s also recommended to keep a list of documents and accounts for your home, vehicles, insurance policies, and investments, among others, with any logins and passwords. See AMG’s Estate Organizer and List of User Names & Passwords/PINs.

Keep these in a secure location and tell your spouse or trustee where to find them.

SAVING FOR A GRANDCHILD’S EDUCATION EXPENSES

You can also get eager grandparents to fund future education and lower their taxable estate through grandparent-owned 529 plans.

- RELATED ARTICLE: Saving for a Grandchild’s Education Expenses

HOW AMG CAN HELP

AMG is a trusted resource for many families, especially those with complicated financial lives. We’re here to help you build and manage your wealth. To find out more about AMG’s Legacy Planning and Personal Financial Management (PFM) or to book a free consultation call 303-486-1475 or email us the best day and time to reach you.

REQUEST REPORT

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.