Housing—Past the Peak?

• 2 min read

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.

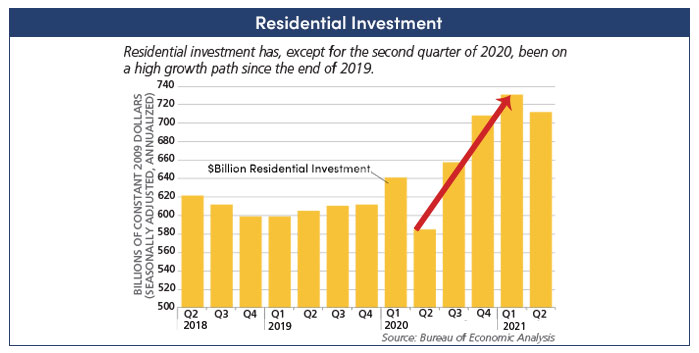

Residential investment fell an annualized 9.8% in the second quarter of 2021. Construction activity is easing, as is the demand for both new and existing homes. It is likely that residential investment will slide downward though 2022.

HOUSING DEMAND IS UNDER PRESSURE FROM HIGH PRICES

Demand for homes is strong, but home prices are going through the roof, affecting affordability. The National Association of Realtors’ Housing Affordability Index, for example, has dropped from 187.8 in January 2021 to 146.3 in July. Falling mortgage rates will no longer compensate for rising home prices. That is not to say home-price bidding wars are over, only that they will likely become less intense as for-sale inventory eventually aligns better with the level of demand.

HOUSING INVENTORY REMAINS LEAN

The housing market faces headwinds from low inventory of existing homes for sale and falling new home construction. Investment in residential structures plummeted during COVID-19-related shutdowns in second quarter of 2020, but recovered strongly, exceeding pre-COVID-19 trends in the quarters that followed. However, the latest quarterly data showed a pull-back in residential investment, suggesting we may be past the peak.

Existing home sales rose only 1.4%, annualized in June and 2.0% in July, recovering from four previous consecutive monthly declines. However, home mortgage purchase applications have been trending down since early in 2021, and pending home sales were off 1.9% in June and 1.8% in July. In any case, relatively few existing homeowners are anxious to sell. The inventory of unsold existing homes is only 2.6 months’ worth of sales.

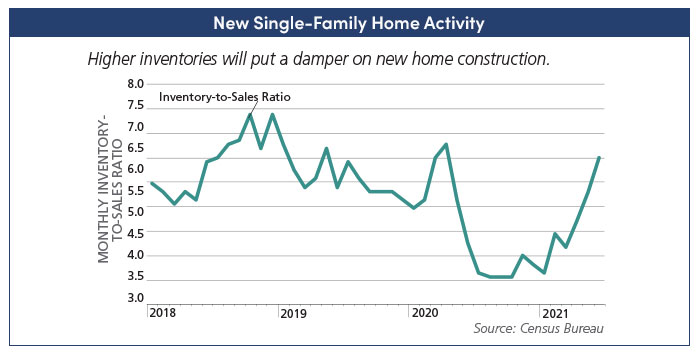

New single-family home sales peaked in January 2021. New home sales, starts, and permits have trended down throughout the year. However, unlike existing home inventories, new home inventories have increased to a level widely considered as normal—equivalent to 6.3 months of sales. That suggests less future upward pressure on new home prices.

If you’ve been considering buying a new home but have been put off by prices, this fall may be a good time to revisit the market.

This article is excerpted from AMG’s quarterly “Notes on the Economy” report. To receive a copy of the Executive Summary or the entire 24-page report, contact your AMG advisor or a request for more information.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.